NEW DELHI: Prime Minister Narendra Modi on Wednesday hailed the next-generation GST reforms, which he mentioned would enhance the lives of residents and guarantee ease of doing enterprise for all, particularly small merchants and companies.“Throughout my Independence Day Speech, I had spoken about our intention to convey the Subsequent-Technology reforms in GST. The Union Authorities had ready an in depth proposal for broad-based GST fee rationalisation and course of reforms, aimed comfy of dwelling for the widespread man and strengthening the financial system,” PM Modi mentioned.He additional mentioned: “Glad to state that GST council, comprising the Union and the States, has collectively agreed to the proposals submitted by the Union Authorities on GST fee cuts & reforms, which can profit the widespread man, farmers, MSMEs, middle-class, girls and youth. The wide-ranging reforms will enhance lives of our residents and guarantee ease of doing enterprise for all, particularly small merchants and companies.“

Finance minister Nirmala Sitharaman on Wednesday introduced main Items and Providers Tax (GST) fee cuts, saying that with the two-tier tax fee system permitted, the widespread man will profit tremendously. The GST Council permitted the two-tier fee construction of 5% and 18%.

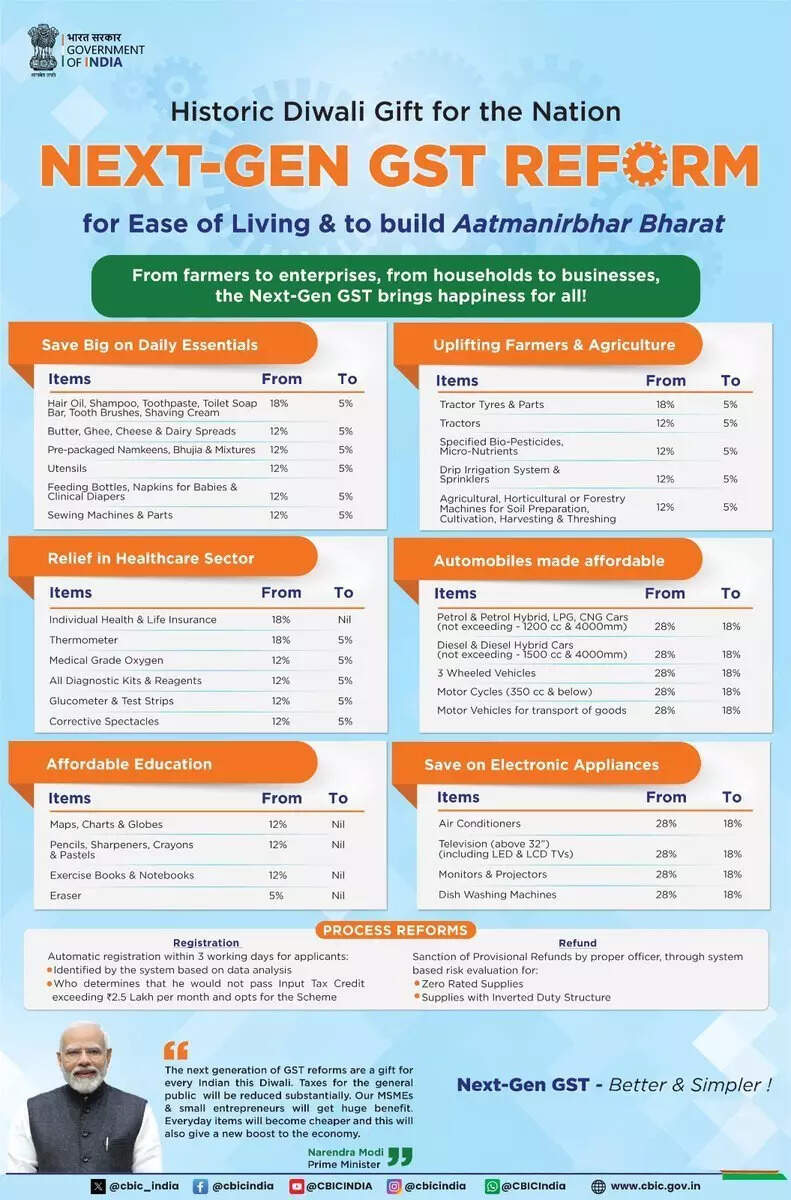

What will get cheaper?

The GST fee rationalisation shall be applied from September 22, in response to a PTI report. “For widespread man and center class gadgets, there’s a full discount from 18% and 12 to five%. Objects corresponding to hair oil, rest room, cleaning soap bars, cleaning soap bars, shampoos, toothbrushes, toothpaste, bicycles, tableware, kitchenware and different family articles at the moment are at 5%,” FM Sitharaman mentioned. “UHT milk, paneer, all of the Indian breads will see nil fee,” she added. The 56th Items and Providers Tax (GST) Council assembly commenced on Wednesday to overview potential fee reductions and class changes for quite a few gadgets underneath the oblique taxation system.