US President Donald Trump’s transfer to impose sanctions on two of Russia’s largest oil suppliers – Rosneft and Lukoil – spells dangerous information for India’s personal sector refineries Reliance Industries (RIL) and Russia-backed Nayara Power.Analysts are of the view that the newest spherical of sanctions could hit earnings of those two oil refineries. In keeping with an ET report citing trade analysts, the sanctions imposed by the USA are anticipated to cut back Reliance Industries’ EBITDA by roughly ₹3,000-3,500 crore.Earlier, India relied closely on Center Japanese imports. Nonetheless, after the Russia-Ukraine conflict started in early 2022 and the G7 imposed a $60-per-barrel worth ceiling on Russian oil revenues, India shifted focus to procuring Russia’s crude accessible at heavy reductions.

How will Trump sanctions on Russia oil affect Reliance, Nayara?

The sanctions introduced by Trump will probably be a blow to Reliance and Nayara Power Further affect is anticipated on government-operated oil advertising and marketing corporations together with Indian Oil Company, Bharat Petroleum Company, and Hindustan Petroleum Company.

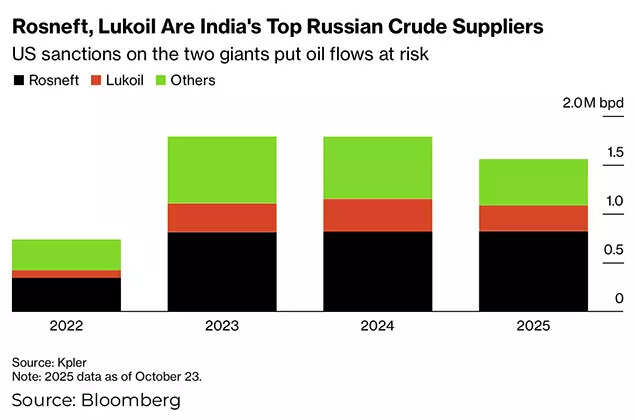

Rosneft, Lukoil are India’s high Russian crude suppliers

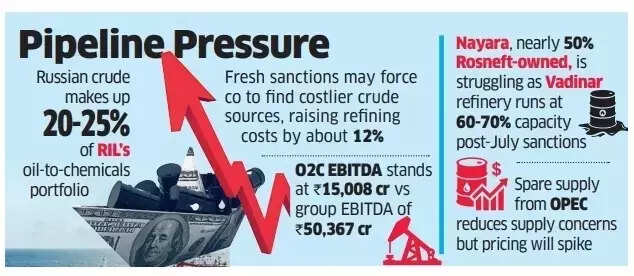

Trade specialists consider that Russian oil makes up roughly 20-25% of RIL’s oil-to-chemicals operations. The corporate at present has an settlement to buy roughly 500,000 barrels of crude day by day from Rosneft.“RIL, which had signed a crude provide cope with Rosneft, won’t be able to honour their settlement given the contemporary sanctions,” mentioned an analyst monitoring RIL, including that the transfer may elevate refining section prices by about 12% as they search different crude sources.The corporate’s present O2C section EBITDA stands at ₹15,008 crore, while the overall group EBITDA is recorded at ₹50,367 crore.Additionally Learn | ‘Robust immunity to Western restrictions’: Russia hits out as Trump sanctions its oil corporations; ‘step fully counterproductive’“Subsequently, even when there’s a hit, the utmost affect could possibly be about ₹3,000-3,500 crore. From a bunch perspective, RIL might be able to soak up this and transfer on,” the analyst continued.Specialists point out that for every $1 rise in gross refining margin, RIL sees a 2% development in consolidated EBITDA and a 3-4% enhance in web revenue. RIL’s second quarter monetary report revealed that while O2C section EBITDA improved quarter-on-quarter as a result of increased gas cracks, it was partly counterbalanced by the unique promoting worth of Center East crude and decreased downstream margins.

Sanctions on Russian oil corporations: Pipeline strain

Trade observers recommend that government-operated oil advertising and marketing corporations may face higher dangers from the current sanctions, contemplating that refining and advertising and marketing represent their major operations.“Although the state-run OMCs haven’t got time period contracts, they’ve been receiving a gentle provide of crude from Russia. Dropping 30% of crude provide and dealing with a $2-3 per barrel hit on reductions may considerably have an effect on total numbers,” famous an analyst, explaining {that a} mere $1 discount in gross refining margins can diminish complete earnings by 9-10%.Additionally Learn | No oil from Russia quickly? Trump sanctions to hit India’s crude imports; ‘all however unimaginable for flows to proceed’The scenario at Nayara Power, during which Rosneft has roughly 50% possession, signifies potential difficulties in acquiring crude and advertising and marketing refined merchandise. Presently, their Vadinar refinery in Gujarat operates at 60-70% capability following the primary set of EU sanctions carried out in July.Trade specialists point out that OPEC’s accessible crude capability may assist tackle provide points, although costs will probably be impacted. “Center Japanese crude is offered in ample provide, however the brand new sanctions are anticipated to spike costs,” based on a market observer.