The rupee has been in a downward spiral versus the US greenback – hitting new historic lows and even crossing the 90 mark. The depreciation has been steep, and much more on an actual efficient foundation. In reality, the rupee is among the worst performing main currencies. Specialists are of the view that this weak point might persist within the close to time period, given the uncertainty of the India-US commerce deal, and stress on capital flows – and this may and can influence varied macroeconomic variables in India, if it persists. A persistently weak rupee impacts India by means of 5 main channels, influencing every little thing from inflation and imports to exports, company margins, and even funding choices. Whereas the short-term results are largely destructive—comparable to elevating prices and extra financial stress—a weaker rupee may also assist long-term development by step by step shifting client and producer behaviour, encouraging extra home output and enhancing export competitiveness, says BofA Securities in its newest report.

Rupee’s Depreciation vs Greenback: Some Startling Numbers

- The rupee has depreciated towards the greenback by 4.7% year-to-date in 2025, and over 5.8% within the final 1 12 months.

- In Actual Efficient Change Price (REER) phrases, the weak point has been even bigger, with year-to-date weak point at an estimated 8.6% till November, and 1-year weak point at 12.1%.

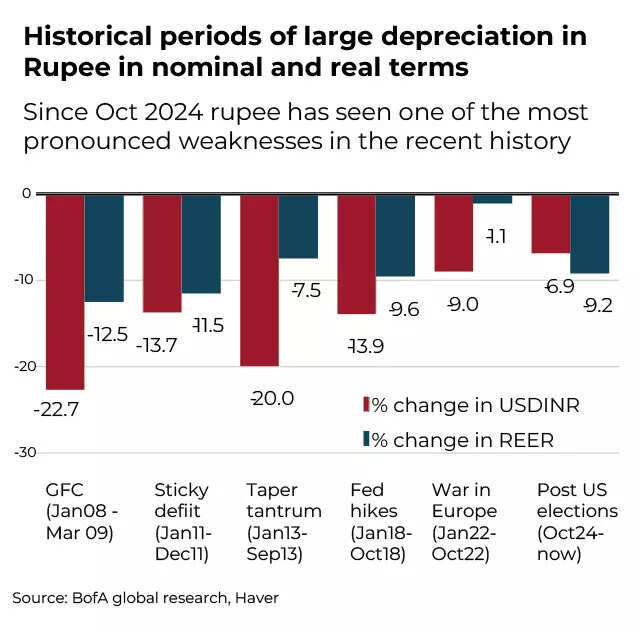

- Based on BofA Securities, it is a great amount of weak point each from the present episode and from a historic context, because the rupee had weakened one thing round 8.7% in 2018, 14% in 2013, and 18.7% in 2008, the earlier episodes of large-scale depreciation within the rupee.

Historic durations of enormous depreciation in rupee in nominal and actual phrases

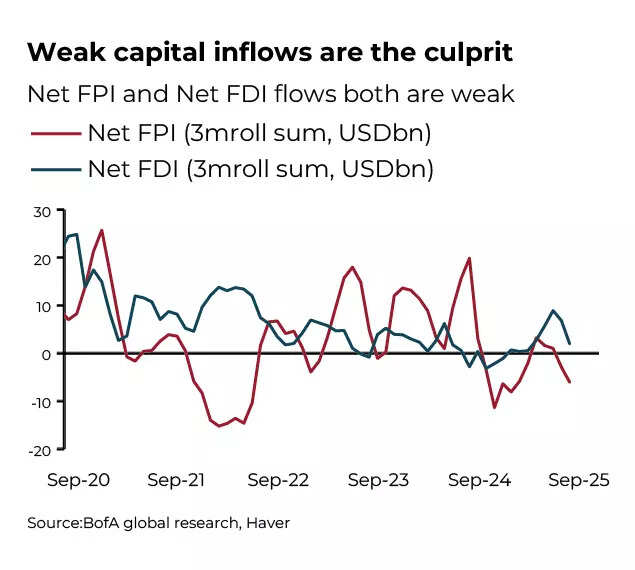

Regardless of current growth within the commerce deficit, India’s present account deficit stays managed. With crude oil costs ranging between $60-65/brl, roughly $15/brl decrease than earlier 12 months’s common, the danger of power prices affecting exterior financing wants seems restricted.“This implies the first problem has been on capital flows, and that has been a difficulty which stays multifaceted, and has been seen throughout FDI flows, FPI flows, and debt associated inflows, which must a sure extent stalled. Certainly, the RBI as per official knowledge has offered $65 billion within the open market between October 24 to September 25, and can also be working a big quick ahead ebook place of $63.6 billion till finish October, which has in all probability elevated in November given the extent of stress on the rupee,” says BofA Securities.

Weak capital inflows are the wrongdoer

What does a weak rupee imply for the Indian financial system? BofA Securities says that the financial influence of a weaker trade is multifaceted, and the trade charge influences a number of macroeconomic variables, by means of the interaction of sentiment, development inflation and different balances.

First channel: Sentiment hit – probably fast and enormous

Based on BofA Securities, traditionally knowledge suggests {that a} weak rupee causes a sentiment hit – which then tends to influence variables and key financial indicators – be it client confidence, enterprise sentiment and coverage uncertainty measurements, PMI. BofA’s evaluation suggests that in durations of greater than 10% weak point within the rupee, the catalyst for sentiment weakening could possibly be seen within the knowledge. “Given the extent of present weak point, it might feed by means of client sentiment and enterprise sentiment probably,” it warns.

Second channel: What occurs to GDP development?

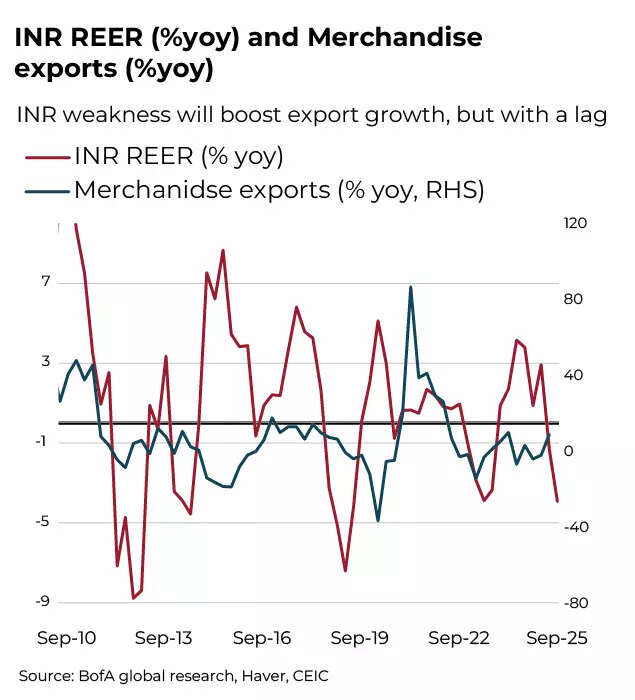

The connection between trade charge and GDP is in a number of methods multifaceted. A number of research, together with from the RBI, have documented the connections between trade charges and GDP development, inspecting each value and quantity implications, particular part results, and temporal facets. The first channel of influence of a weaker trade charge comes by means of each exports and imports, that are the first components counting on the trade charge to an extent, notes BofA.Let’s perceive this higher:The primary impact of a weakened rupee manifests in import patterns – this may notably have an effect on discretionary and consumer-related imports. Analysis signifies {that a} 5% decline in RBI’s Actual Efficient Change Price can lead to a corresponding 2.3% discount in imports. This in flip can push up GDP development by means of the decreased import volumes.Based on a examine executed by ministry of finance in 2023, the outcomes of exports being meaningfully influenced by trade charge weak point has been weakening within the current years, however primarily based on the outcomes, the export sensitivity to five% REER depreciation can sometimes improve exports by ~2%, implying nearly a ~4% enchancment within the present depreciation episode. BofA Securities quotes a current RBI examine which investigated the connection between trade charge fluctuations and commerce stability, and concluded that rupee depreciation in actual phrases enhances the commerce stability progressively. This influence seems extra vital in durations of rupee’s depreciation in comparison with the appreciation durations.

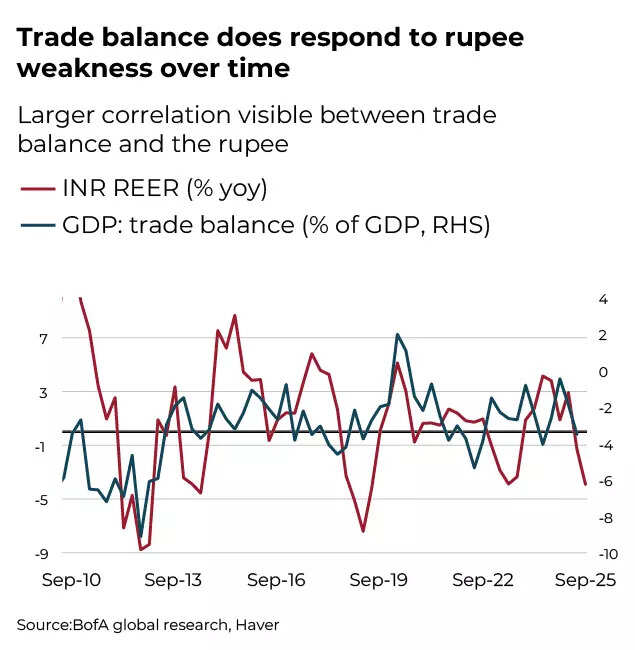

Commerce stability does reply to rupee weak point over time

Their examine confirmed that each within the quick time period and the long run, rupee depreciation does affect the commerce stability positively, doubtless working extra strongly by means of import demand compression, than by means of export enchancment instantly.“Based mostly on this examine, if the present depreciation holds, the implied commerce stability enchancment could possibly be as giant as 5-7% of the commerce stability which in present phrases saves India nearly $7-12 billion, consistent with RBI’s examine,” says the BofA report. “Nonetheless, with the shadow of the weak point emanating from the tariffs imposed by the US, we consider the positive aspects on the commerce entrance, particularly exports can be considerably stunted, however the imports compression remains to be more likely to play out, given the first supply of compression is on the home demand entrance, not exterior entrance,” it provides.

Third Channel: Inflation Hassle

That is one channel that may feed negatively into the financial system, elevating costs and therefore, inflation. However, will that be the case for India? As per the BofA report, traditionally, the trade charge – inflation nexus has all the time been sturdy in India, as sometimes rupee weak point can emanate from elevated inflation, which in flip can set off extra inflation.

Core CPI

This cycle nonetheless shouldn’t be seen within the present state of affairs, and with typical channels of upper imported inflation seems to be comparatively benign to trigger any main inflation spiral, the report says,How does inflation get imported in instances of rupee depreciation? There are three predominant channels:In right now’s state of affairs, the comforting truth is that the autumn in crude oil costs has been extra drastic than the rupee’s depreciation. Additional, even when crude oil costs rise on the margin, the federal government has saved the value of gas in India elevated, over and above the implied costs primarily based on crude oil ranges, leading to elevated gross advertising margins for oil firms, notes BofA.. “As such, even after a weaker trade charge, the necessity to increase retail gas costs will keep restricted. This will not be the case for all power merchandise, or valuable metals, which have been shifting up, and the go by means of will proceed to be seen within the knowledge,” it provides.

Gold costs

- Intermediate and client items

BofA is of the view that the continued deflationary traits in China have unfold throughout the area, together with India. This implies that the results of a weakened trade charge may very well be restricted. “That is seen because the persistent weak point in WPI inflation, which displays enter prices, and is rather more delicate to a weaker trade charge and imported costs. Certainly, after a quick interval, WPI inflation has been destructive for an prolonged interval, and in index phrases, WPI index nonetheless stays under the highs seen in June 2022,” it says.Earlier RBI analyses and present quarterly projection fashions point out {that a} 5% discount in REER can really trigger a 35-basis factors rise in inflation throughout 3-4 quarters. This implies that there could possibly be a possible 60-70 foundation factors upward danger to inflation. Nonetheless, contemplating the worldwide financial context, this end result appears unlikely within the present section of rupee weakening, says BofA. Based on the RBI, about 36.4% of the current inflation basket is immediately or not directly impacted by imported costs, which naturally could also be impacted by a weaker trade charge. Total, whereas a considerable amount of rupee weak point is a precursor for greater inflation, the distinctiveness of the worldwide commodity value backdrop and the persistence of low meals inflation can be certain that the go by means of of a weaker trade charge is considerably much less.The prospect of a good rabi crop sowing season can even additional blunt the inflation influence, as quantity development will ensue even when enter prices rise, the go by means of can be considerably quelled by giant shares availability.

Fourth channel: Exterior Sector

On the exterior sector entrance, the long-term influence may very well bode nicely for the Indian financial system. The influence on exterior funds is anticipated to be extra noticeable by means of present account dynamics somewhat than capital account actions. Historic evaluation means that commerce stability really improves – imports take successful as a result of they price extra and exports get a leg up as a result of they’re cheaper for the nation that imports them.“For the implied commerce stability, the development primarily based on historic sensitivities may be wherever between 0.8-1 instances primarily based on historic research,” says BofA Securities. “Nonetheless, the weak point in US commerce exercise, particularly with exports, provides a component of uncertainty on the products commerce enchancment that may sometimes be seen after each main correction within the rupee on actual phrases. This might imply that the everyday “J – Curve” impact will not be as shortly seen within the knowledge if rupee weak point persists, however ultimately it needs to be seen, probably in 2-4 quarters,” it provides.

Rupee weak point can increase export development

The depreciation of the rupee would considerably improve competitiveness in providers commerce, though preliminary greenback surpluses may lower as operational prices in India, notably for GCCs, scale back.“This might imply lesser have to ship operational capital, however over time may additionally lead to a bigger incentive to broaden capability given price efficiencies. As per an RBI examine, providers exports enhance by 0.8% for each 1% FX weak point over time. For different providers objects comparable to tourism and training, a weaker rupee would cut back incentives for outbound exercise, however whether or not it may be seen meaningfully in a short while interval is debatable,” says BofA.

INR REER and Secondary Earnings

The circulation of remittances is an enormous optimistic of rupee depreciation. For remittances, bouts of a weaker trade charge can lead to a small interval of decrease inflows, however sometimes as soon as the rupee depreciation stalls, it’s adopted by a significant improve in remittances circulation, to make use of the higher cross trade charge. This isn’t the case with main transfers, which generally shouldn’t be impacted throughout foreign money fluctuations, the report says.“Total, we consider the present account deficit tends to shrink over a time period submit a pointy bout of foreign exchange weak point, however that’s extra more likely to be seen within the subsequent 3-6 months, somewhat than the following 1-2 months. On the capital flows facet, we don’t see any significant influence of a weaker trade charge on each FDI and FPI flows, however a weaker rupee can add to the private and non-private debt burden on the margin, particularly if they don’t seem to be matched totally from a foreign exchange hedging perspective. There’ll nonetheless be some improve in debt burdens, however we consider its implications can be comparatively nicely managed,” it provides.

Fifth Channel: Does the fiscal scenario pose a danger?

On the fiscal facet of the financial system, the implications of a weaker rupee aren’t instantly clear. That is particularly so because the authorities now not subsidizes gas consumption meaningfully, exterior of LPG merchandise. While LPG subsidies may improve marginally, fertiliser subsidies are more likely to expertise a extra substantial rise as a result of foreign money depreciation.

Subsidies

The vital factor is that the present rupee depreciation, mixed with RBI’s ongoing market interventions, is more likely to improve the central financial institution’s overseas trade earnings. This might lead to elevated RBI dividend funds in fiscal 12 months 2026-27, providing potential income assist.“This can be an identical dynamic to the weak point in rupee seen final 12 months, probably with a bigger depth, given the extent of intervention this 12 months has been a lot bigger in promoting overseas trade, which generally yields the RBI earnings. As such, the general fiscal influence stays unclear to us, as there are optimistic and destructive facets of the trade charge weak point in our view,” BofA Securities says.

The place is the rupee headed?

The India-US commerce deal is a key think about ongoing weak point in rupee, and an efficient decision might pave the best way for a comparatively stronger rupee in comparison with the current state of affairs.BofA analysts are of the view that the rupee nonetheless stays depending on portfolio flows subsequent 12 months after giant fairness outflows this 12 months partly pushed by tariffs. “Finalization of commerce deal to scale back the tariffs could be vital in lowering uncertainty for fairness buyers,” it says. “Additional pick-up in development momentum could be one other key issue for subsequent 12 months which can assist company earnings and ease fairness valuation issues,” it provides.Given this uncertainty, BofA believes that the central financial institution’s administration of rupee ranges can be key. “RBI’s reserves stay satisfactory, however continued portfolio outflows may make these operations unsustainable or build-up of RBI’s quick greenback ahead positions might skew return expectations on the rupee,” it says.“Total, we consider greenback weak point subsequent 12 months would nonetheless assist delicate rupee appreciation and that might pick-up tempo across the seasonally favorable first quarter for the rupee. We forecast the rupee to achieve 86/USD by end-2026, consistent with greenback weak point subsequent 12 months,” it says.Despite the fact that the RBI has been letting the rupee weaken to scale back stress on the trade charge markets, BofA believes that the RBI will doubtless keep concerned in each the spot and forwards market, offering liquidity and curbing volatility. “Certainly, within the newest RBI assembly, the governor clearly said that the tolerance for rupee volatility has not modified for the RBI, in our view, and we might count on them to stay seen, and smoothen out the path of the transfer, with out essentially anchoring any particular stage. This has been the technique by means of 2025, the place RBI has opportunistically offered and acquired overseas trade, when it may, and if inflows return in a significant method, we consider the RBI may have a desire to rebuild its exterior buffers,” it provides.