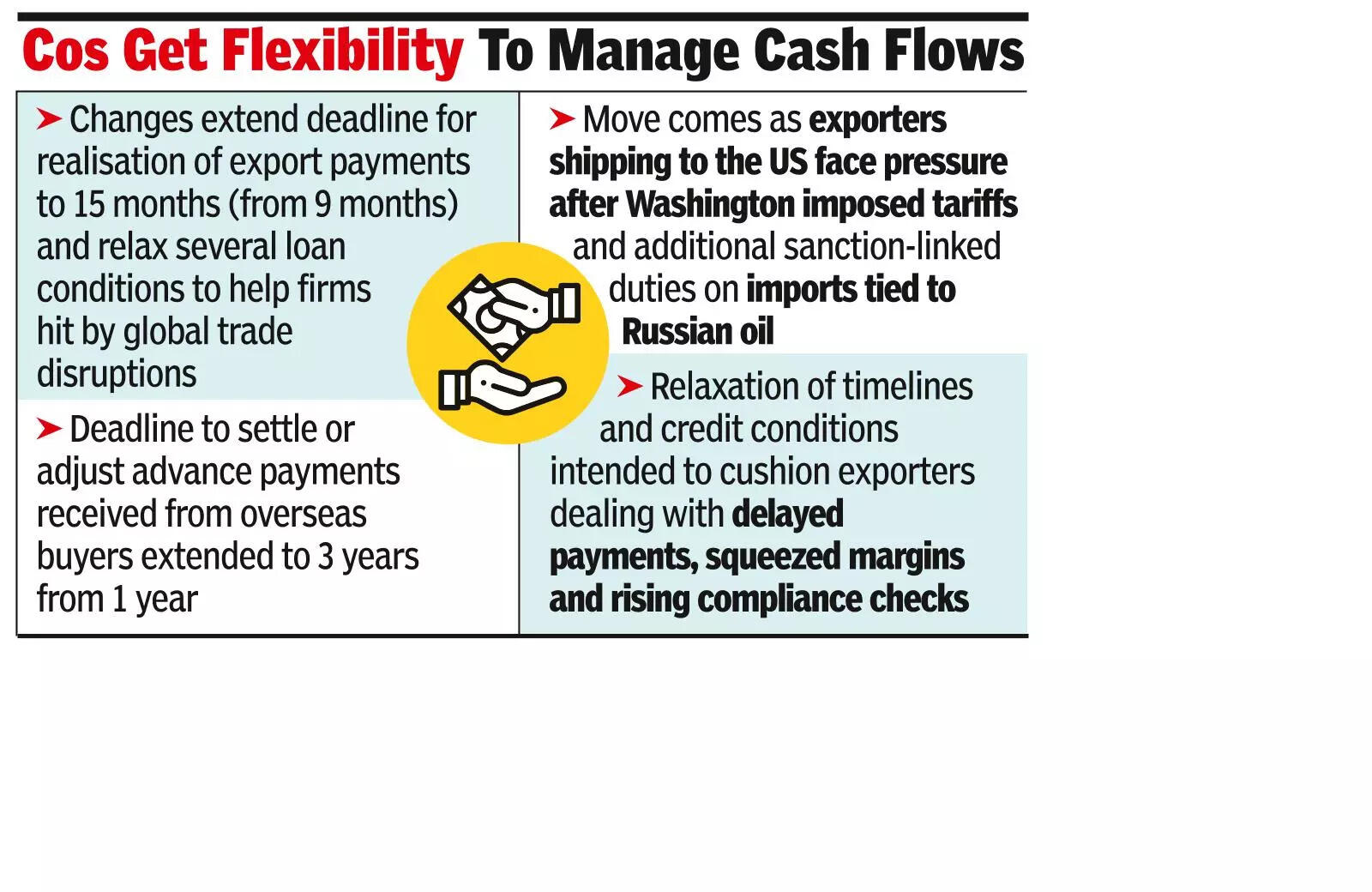

MUMBAI: Days after govt introduced the ‘export promotion mission’ and simpler mortgage stream, RBI has eased reimbursement guidelines for exporters by giving them extra time to usher in the proceeds and permitting banks to supply momentary aid on trade-related loans. The modifications, issued by way of a Gazette notification on Nov 13 amending Fema guidelines and a round to lenders, lengthen the deadline for realisation of export funds to fifteen months (from 9 months) and calm down a number of mortgage situations to assist companies hit by world commerce disruptions.The transfer comes as exporters transport to the US face stress after Washington imposed tariffs and extra sanction-linked duties on imports tied to Russian oil. RBI’s rest of timelines and credit score situations is meant to cushion exporters coping with delayed funds, squeezed margins and rising compliance checks of their key markets.

Beneath the amended Fema laws, exporters have 15 months as an alternative of 9 to deliver again their export earnings. The deadline to settle or regulate advance funds acquired from abroad patrons has been prolonged to 3 years from one 12 months. RBI mentioned the longer timelines are supposed to ease stress on exporters scuffling with delays in shipments and funds.A separate round to banks, cooperatives and NBFCs outlines how lenders ought to help affected exporters. Corporations in specified sectors that held commonplace export credit score as of Aug 31 could also be supplied a four-month moratorium on mortgage installments and curiosity from Sept 1 to Dec 31. Curiosity will proceed to accrue, however solely as easy curiosity. Lenders could convert this right into a separate mortgage, which will be repaid between April and Sept 2026.Banks have additionally been allowed to ease working-capital guidelines by decreasing margins and recalculating drawing energy. They could give exporters as much as 450 days to repay pre-shipment and post-shipment credit score. Exporters who’ve produced items however can’t ship them could repay packing credit score utilizing home gross sales or proceeds from different export orders. RBI mentioned these relaxations won’t be handled as restructuring, and lenders should guarantee debtors’ credit score histories are usually not affected. Banks will, nonetheless, have to create a 5% normal provision towards such accounts as a prudential buffer.The central financial institution mentioned the measures are meant to forestall short-term commerce disruptions from turning into defaults, give exporters flexibility to handle money flows and permit lenders to help viable companies with out weakening credit score self-discipline.