LG Electronics India on Tuesday had a stellar itemizing on the inventory exchanges NSE and BSE, debuting at a whopping premium of fifty% above its share value situation. Buying and selling commenced at Rs 1,715 on BSE and Rs 1,710.10 on NSE, significantly above the Rs 1,140 per share situation value, leading to day-one returns exceeding 50% for traders.The Rs 11,607-crore public providing consisted solely of shares divested by LG Electronics Inc. The difficulty garnered overwhelming curiosity, securing 54-fold oversubscription. The certified institutional patrons’ phase witnessed 166 instances subscription, while retail traders’ portion achieved 3.5 instances subscription.Earlier than the official itemizing, the shares attracted sturdy demand within the gray market, buying and selling at a 31% premium, reflecting sturdy investor confidence.The debut takes place in India’s second-busiest IPO quarter, although current main listings, together with WeWork India and Tata Capital, skilled comparatively modest market debuts.So why is the LG Electronics India itemizing vital and what does it imply for the IPO market in India?

LG Electronics’ Stellar itemizing

The IPO efficiency stands as essentially the most spectacular amongst Indian choices exceeding one billion {dollars} since 2021, inserting the organisation forward of rivals reminiscent of Whirlpool, Voltas and Havells.The rise pushed the organisation’s market valuation past different listed Indian shopper durables corporations, together with Whirlpool of India ($1.7 billion), Voltas ($5.8 billion) and Havells India ($10.4 billion).

LG Electronics India extra beneficial than South Korean mother or father firm!

Apparently, LG’s market capitalisation reached Rs 1.16 lakh crore (roughly $13.13 billion), surpassing its South Korean mother or father LG Electronics Inc’s worth of $8-9 billion on the Seoul change!Based on consultants, the corporate’s success stems from its smart valuations, market management place and clear earnings prospects. LG holds a dominant place in India’s shopper durables sector with its numerous vary of house home equipment, TVs and ACs, constantly outperforming opponents in profitability and enlargement, in accordance with an ET report.Ambit Capital assigned a Purchase score with a 12-month goal of Rs 1,820, noting a number of optimistic elements supporting the corporate’s outlook, together with localisation, premium product focus, elevated exports and GST-driven market restoration.“LG’s under-penetration throughout classes leaves ample room for progress. The Six Metropolis plant will double capability and increase exports by 4 proportion factors by FY28E,” the brokerage mentioned. Their forecast signifies 11% income and 13% EBITDA CAGR via FY25-28.The IPO pricing proved interesting to traders. At 35x FY25 earnings, LG introduced higher worth in comparison with listed opponents buying and selling at 45-60x multiples. Further elements strengthening investor belief included its debt-free standing, constant ROE exceeding 30%, and secure EBITDA margins above 10%.

LG Stands Tall In Rs 10,000 crore IPO Membership

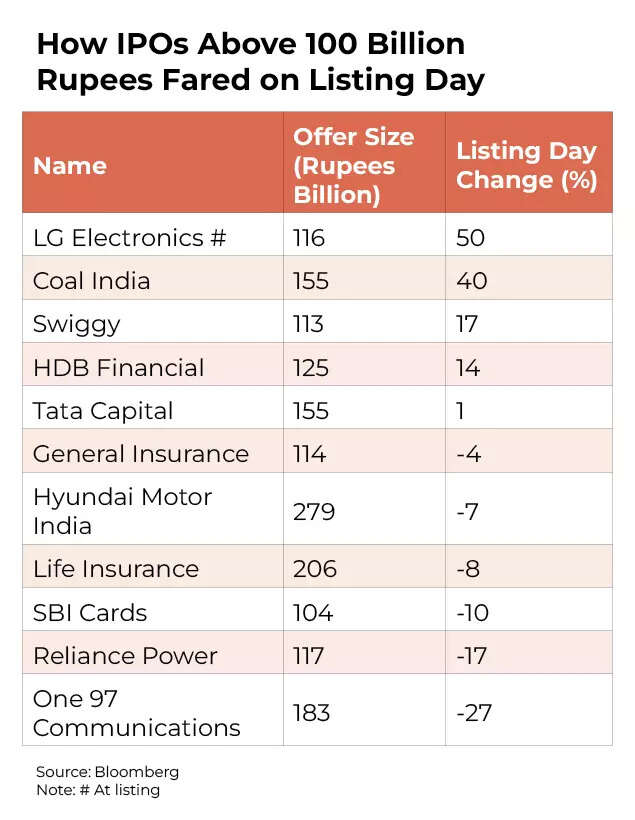

The itemizing proved exceptionally rewarding for traders and set a brand new benchmark amongst India’s Rs 10,000-crore-plus IPOs, the place such points sometimes battle to keep up momentum post-listing. LG India recorded the very best day-one premium of fifty.4% amongst IPOs exceeding Rs 10,000 crore.Historic information of serious Indian listings reveals numerous outcomes. Coal India’s public providing in 2010, which raised Rs 15,199 crore, stays amongst the profitable ventures, starting 40% larger.

How above Rs 100 billion IPOs fares on itemizing

In distinction, Reliance Energy’s 2008 situation began 17% decrease, whereas Paytm’s Rs 18,300-crore providing in 2021 fell 27% at itemizing. State-backed enterprises encountered difficulties too, with LIC’s Rs 20,557-crore situation opening 7.8% decrease and GIC Re’s Rs 11,257-crore providing beginning with a 4.6% decline.Contemplating these precedents, LG India’s market debut stands out amongst substantial Indian IPOs, reflecting each scale and powerful investor confidence.

Extra IPOs loading – what LG’s stellar itemizing means

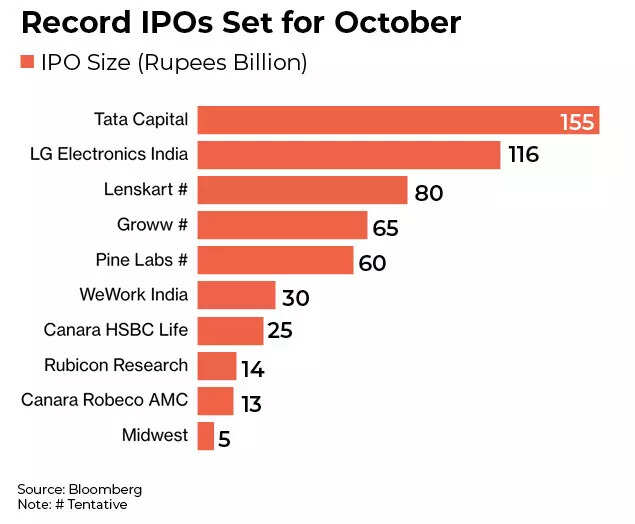

The spectacular first-day efficiency serves as a optimistic indicator for upcoming Indian company listings, significantly following Tata Capital Ltd.’s modest 1.4% improve throughout its debut within the nation’s largest preliminary public providing this 12 months.Over the previous two years, India has emerged as one of many world’s most energetic markets for public listings, attracting worldwide traders eager to take part in its quickly increasing shopper market.October is poised to set a file for Indian IPOs, with anticipated proceeds exceeding $5 billion. The market has intently monitored each LG and Tata’s choices as indicators of stability in one of many world’s most vibrant IPO markets.

Report IPOs Set for October

Based on Bloomberg information, these current choices have pushed the whole IPO proceeds in India past $15 billion this 12 months. The surge in important choices has generated confidence that the whole may exceed final 12 months’s milestone of almost $21 billion. Jefferies Monetary Group beforehand indicated that India’s main market is positioned for substantial progress following a quiet begin, projecting fundraising of as much as $18 billion within the latter half of the 12 months.

IPOs a Hit Even As Nifty, Sensex Nonetheless Under Highs

Amidst worldwide market fluctuations, India maintains its standing because the second-largest IPO market globally, following the US. This place is supported by sound financial fundamentals, improved regulatory framework, and elevated participation from retail traders.Though overseas traders have been constantly promoting within the secondary market, they preserve substantial confidence in India’s main progress narrative by taking part as dedicated anchor traders in firms’ preliminary public choices.The Indian IPO sector demonstrates distinctive vitality, producing roughly 1% of the nation’s GDP, R. Venkataraman, Managing Director of IIFL Capital instructed ET just lately.The prevailing sturdy valuations and conducive market surroundings are permitting enterprise homeowners to safe capital for enlargement while partially realising their investments.Consultants are of the view that firms at their itemizing stage are sometimes of their early progress section, doubtlessly providing larger returns in comparison with established listed entities, in accordance with Shah. Further benefits of IPOs embrace minimal value impression from bulk purchases and alternatives to spend money on distinctive enterprise fashions at aggressive valuations.(Disclaimer: Suggestions and views on the inventory market and different asset lessons given by consultants are their very own. These opinions don’t symbolize the views of The Instances of India)