MUMBAI: When HDFC started providing residence loanswithin the late Seventies, credit score was a privilege, accessed cautiously and late in life. A big downpayment was a prerequisite, and solely these of their 40s, with years of financial savings, might sometimes afford to borrow.At this time, credit score is accessed a lot earlier and extra casually, with a rising variety of Indians beginning their credit score journey of their mid-20s.

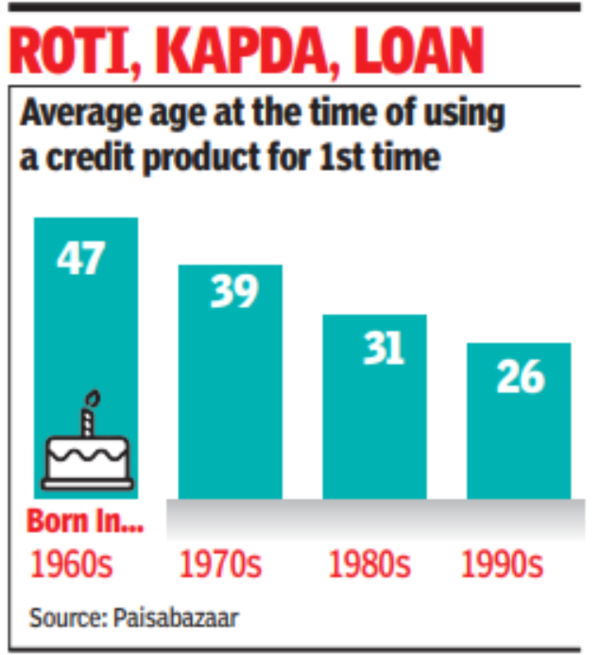

The common age at which Indians avail their first credit score product has fallen by 21 years throughout three generations, a research by Paisabazaar confirmed. Okay Cherian Varghese, former chairman of Company Financial institution, who started his banking profession 5 a long time in the past says that the flexibility to borrow is instantly linked to the dimensions of disposable earnings. “Private loans are taken both to finance buy of some asset like residence mortgage or for consumption. Within the 70s, the disposable earnings was not sufficient to service the mortgage EMIs. At this time, in many roles like IT, the staff get a good wage that enables them to satisfy all bills and repay their EMIs,” stated Varghese. He provides that immediately banks have pre-approved many company employers and are prepared to supply a set of credit score merchandise to their workers making credit score way more accessible.

Whereas the credit score bureau made it simpler for lenders to establish delinquents, the Jan Dhan-Aadhaar-Cell trinity made it simpler to maintain monitor of debtors. The research, which is predicated on the credit score behaviour of over 10 million shoppers, confirmed that these born within the Nineteen Sixties started borrowing at 47, largely by way of secured loans like mortgages. In distinction, people born within the Nineteen Nineties sometimes enter the credit score ecosystem by the age of 25-28, typically by way of unsecured merchandise similar to bank cards, private loans, and client sturdy loans.

This shift displays the broader development of simpler entry to credit score and a altering client mindset – one which values on the spot gratification over extended financial savings. Whereas the primary bank card in India was launched by Central Financial institution with Mastercard within the early 80s, it was a really extremely restricted product. The cardboard was supplied largely to tax-paying excessive earners. It wasn’t till Citi, SBI and ICICI began providing playing cards to a wider viewers that playing cards picked up.

The research traces how the entry level into the credit score system has developed. For these born within the Nineteen Sixties, residence loans have been the primary credit score product. For the Seventies and Nineteen Eighties cohorts, auto loans grew to become the popular start line, availed at common ages of 39 and 31, respectively. The common age for a first-time residence mortgage borrower has declined from 41 (for these born within the Seventies) to twenty-eight (for the Nineteen Nineties-born).