NEW DELHI: The Centre is about to levy a brand new cess on tobacco, tobacco merchandise and pan masala after the phaseout of GST compensation cess to make sure that worth of those merchandise don’t fall as they’re sin items.On the time of GST revamp, govt had introduced continuation of compensation cess just for tobacco and pan masala, whereas withdrawing it on all different merchandise and altering the charges, which resulted in decrease levy for a number of merchandise. Among the items had moved into the 40% sin items bracket.

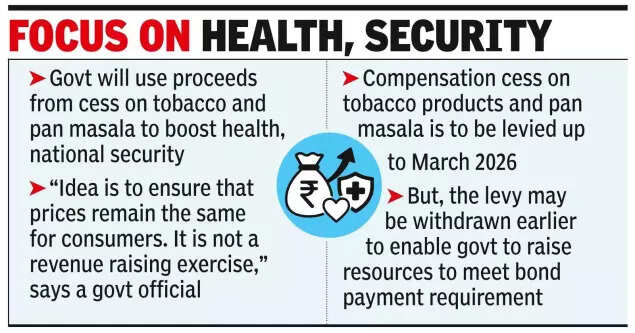

Whereas the compensation cess on tobacco merchandise and pan masala is to be levied as much as March 2026, there’s a chance of the levy being withdrawn earlier because the Centre will be capable of increase sources to satisfy the bond fee requirement. Because of this, the well being and safety cess that’s proposed on these two sin items segments will kick in from the date that will likely be notified.On Monday, finance minister Nirmala Sitharaman is scheduled to introduce a invoice “to enhance the sources for assembly expenditure on nationwide safety and for public well being, and to levy a cess for the stated functions on the machines put in or different processes undertaken by which specified items are manufactured or produced and for issues related therewith or incidental thereto”, in response to the enterprise listed for the Lok Sabha.The transfer additionally paves the best way for the government to allocate extra sources for defence, amid heightened stress within the neighbourhood.Govt is hoping that the invoice is handed throughout the Winter Session itself in order that the date might be notified, each time required.On the time of the GST revamp announcement in Sept itself, govt had indicated {that a} new cess will likely be imposed on the 2 merchandise. “The thought is to make sure that costs stay the identical for customers. It isn’t a income elevating train,” stated a govt official.On the time of the launch of GST in 2017, the Centre and the states had agreed to the compensation cess on sin and luxurious items, reminiscent of automobiles, yacht, smooth drinks, coal, tobacco and pan masala. The thought was to make sure that states had been assured of an annual 14% enhance of their oblique tax kitty for 5 years. Covid outbreak and the lockdown, nonetheless, upset the calculations ensuing within the cess persevering with until March 2026, till the GST Council agreed to the restructuring earlier this yr.