NEW DELHI: The commerce division on Wednesday unveiled the weather of the Export Promotion Mission targeted on offering low-cost and collateral-free loans, backing new devices, supporting alternatives in new markets and boosting export credit score to e-commerce, amid considerations that the general allocation of Rs 2,250 crore was unfold too thinly.

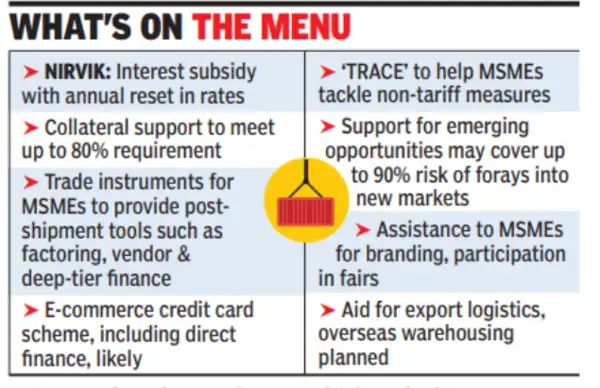

High of the agenda is Niryat Rin Vikas or NIRVIK, an curiosity equalisation scheme focused at MSMEs and new exporters. The plan is to reset rates of interest yearly by benchmarking them to charges in different nations that Indian exports are competing with. The choice flows from the realisation inside govt that rates of interest in India are twice, if not thrice, the extent in nations resembling China, South Korea, Singapore, Malaysia, and Thailand.

The scheme will include a specified cap with a damaging record of sectors linked to parameters, resembling low worth addition, uncooked materials or main merchandise, and objects the place there’s a excessive chance of misuse, sources informed TOI. Exporters will get the profit upfront with banks getting reimbursed.

Govt can be in search of to finish the hardship confronted by exporters – particularly MSMEs and e-commerce – because of banks demanding collaterals. The plan is to offer over 80% of the collateral requirement based mostly on observe file by means of a web based analysis and monitoring mechanism. Exporters will probably be given a singular ID with fund disbursals on a month-to-month or quarterly foundation beneath the scheme the place a credit score assure fund will probably be roped in.

The commerce division has additionally lined up plans to offer simpler entry to working capital by means of commerce finance devices, with post-shipment instruments, resembling factoring, reverse factoring, and vendor financing for small exporters. The general profit will include a ceiling, sources indicated.

Equally, to help rising alternatives, the govt. intends to share as much as 90% of the chance of MSMEs, which wish to enterprise into “new, high-risk markets”, with no less than 1,000 exporters to be backed within the first yr. The Centre intends to make use of the Commerce Help Fund to put money into liquid property allowed beneath EXIM Financial institution’s funding coverage, sources mentioned.

A Centered Market Entry Initiative can be deliberate to assist exporters faucet new alternatives. Govt will help their participation in festivals and meet as much as 90% of the price. This will probably be along with a lift for branding.