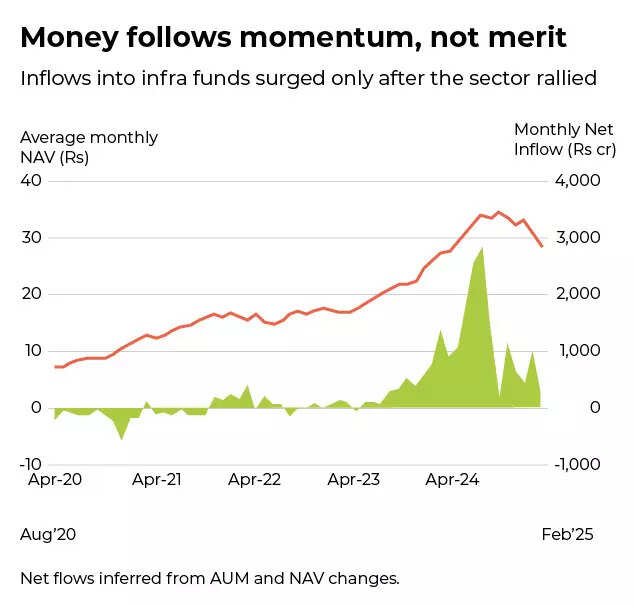

You don’t have to see enterprise information channels to know when markets are doing nicely. You simply have to attend a marriage.Out of the blue, the cousin who by no means replied to your messages is giving inventory suggestions. The uncle who used to debate blood strain is now discussing small-caps. Your workplace WhatsApp group is half jokes, half revenue screenshots. And there you’re, sitting together with your boring SIP or much more boring FD, questioning, “Am I the one fool not making simple cash?”That sinking feeling has a contemporary title: FOMO – Worry Of Lacking Out. In actual life, it often means “different individuals are sounding good, and I’m quietly doubting myself.”The very first thing to know is that this: individuals discuss loudly about good points and really softly about losses. You’ll at all times see the screenshot the place they purchased at ₹100, and it went to ₹150. You’ll not often see the one the place they purchased it for ₹150, and it went all the way down to ₹80. Social media just isn’t a portfolio assertion; it is a spotlight reel.Once we dig into the numbers at Worth Analysis, a transparent sample emerges: classes develop into widespread solely after a robust rally. Cash doesn’t anticipate efficiency; it chases it. This behaviour reveals up throughout the market, and Infrastructure funds supply one of many clearest current examples.

Cash follows momentum, not advantage

Now, let me introduce two imaginary traders whom you might have undoubtedly met in actual life: Rohan and Meera.Rohan is the basic FOMO investor. He hears from colleagues and relations a few “star” small-cap or sector fund. He opens his app, sees a unbelievable one-year return, feels a mixture of jealousy and pleasure, and instantly shifts an enormous chunk from his easy diversified fund into this sizzling new concept.Meera is the boring one. She began a SIP in a wise, diversified fund three years in the past. She has heard about the identical sizzling fund. She’s tempted for 5 minutes, shrugs, and carries on along with her present plan.Now freeze the body there and fast-forward 4 years.

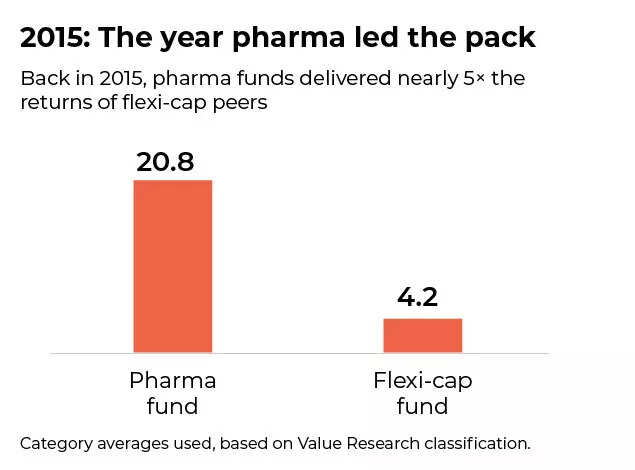

2025 – The yr pharma led the pack

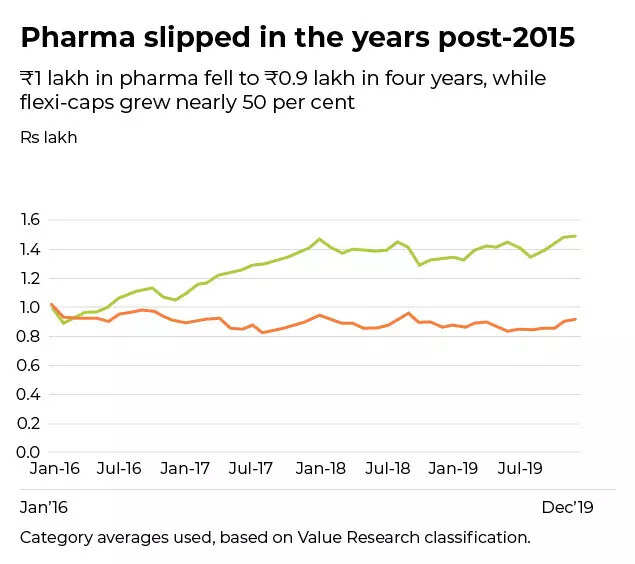

Pharma slipped within the years post-2015

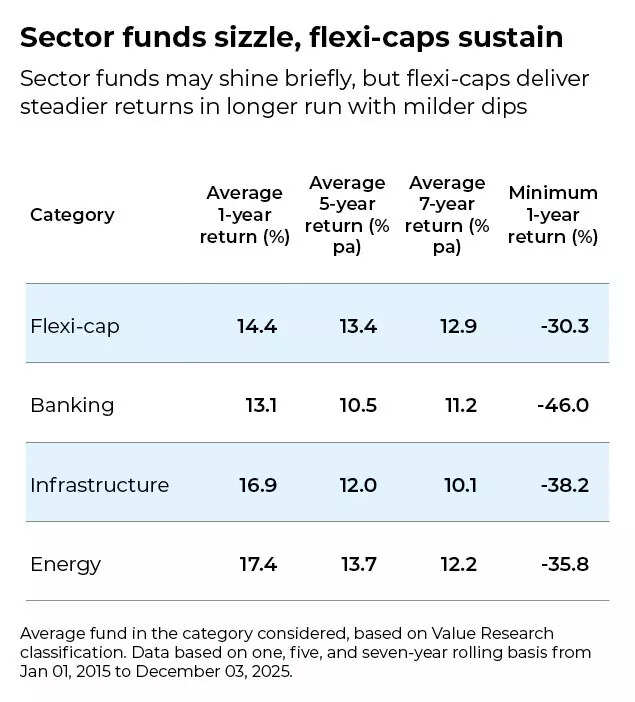

The punchline is boring however essential: Rohan felt updated and intelligent; Meera felt outdated and boring. However Meera’s cash quietly did higher. This isn’t only a story; it’s what we repeatedly see in information. Once we calculate “investor returns” – what the common investor truly earns – versus “fund returns” – what the fund delivered over time – there’s usually a spot. An enormous cause is FOMO-driven timing: individuals enter late, after a great run, and lose persistence within the subsequent tough patch.Why is FOMO so highly effective? First, we hate feeling just like the odd one out. When everyone seems to be in some small-cap, IPO or crypto and also you’re not, it seems like a mistake, even when your personal plan is completely wonderful. Second, our brains are hard-wired to chase current efficiency. That shiny one-year return quantity in fund tables is sort of a plate of jalebis: you recognize an excessive amount of is dangerous, however your hand nonetheless goes there. Third, we confuse repetition with reality. The extra you hear a few fund or theme on TV, YouTube and WhatsApp, the extra “apparent” and “secure” it begins to sound.At Worth Analysis, our job is to be barely boring in the course of this drama. We take a look at rolling returns over lengthy intervals, not simply final yr. We take a look at how a fund behaves in crashes, not simply in bull markets. We evaluate it in opposition to its index and friends, and we take a look at the danger it took to get these numbers. Whenever you do this, many sizzling concepts look much less spectacular.So, how do you reside in a FOMO-heavy world with out turning into a hermit?Step one is to ask a quite simple query: Am I constructing a portfolio for my objectives, or for different individuals’s conversations? Your baby’s school charges don’t care what your colleagues purchased final month. Your retirement doesn’t care about your brother-in-law’s multibagger story from 2017. FOMO is about their story; private finance is about yours.The second step is to simply accept that you’re human. If you happen to actually can’t resist the urge to experiment, don’t faux you’re above it. As an alternative, put it in a field. Resolve {that a} small portion of your cash – say, 5 to 10 per cent of your fairness allocation – is your “mad cash” nook. That’s the place you’re allowed to do all of the thrilling issues: themes, sectors, IPO punts, the fund your cousin gained’t cease speaking about. The remaining ninety to ninety-five per cent ought to keep in a boring, well-constructed plan aligned to your objectives and danger capability. That method, your experiments can go unsuitable – and lots of will – with out setting fireplace to your future.The third step is to zoom out. As an alternative of obsessing over the most recent one-year return, take a look at full cycles of seven to 10 years.

Sector funds sizzle, flexi-caps maintain

Once we analyse funds this fashion at Worth Analysis, the quiet, regular ones look much more engaging. Not as a result of they high each desk, however as a result of they allow you to keep invested.Right here’s a easy rule you may take into accout the following time a fund or inventory comes up at a celebration: if I hear about it from 5 completely different individuals directly, I’m in all probability late. That doesn’t imply it’s mechanically dangerous. It simply means your choice ought to come out of your plan, not your FOMO.You don’t need to attend each social gathering the market throws. One or two small events are wonderful. However the true wealth is constructed by exhibiting up for the lengthy, barely boring, dependable relationship – not the most recent thrilling fling.In case you have any queries for Dhirendra Kumar you may drop us an electronic mail at: toi.enterprise@timesinternet.in(Dhirendra Kumar is Founder and CEO of Worth Analysis)