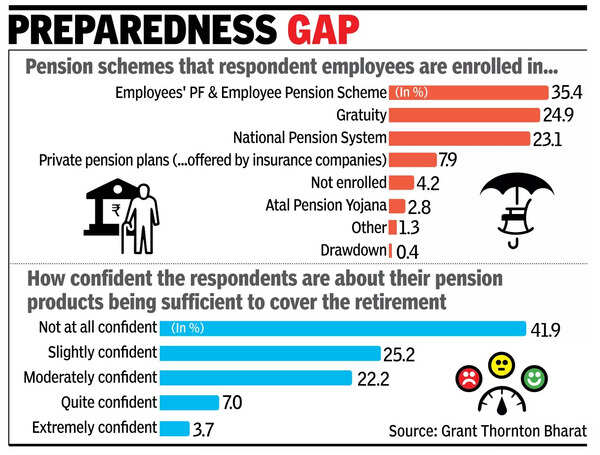

NEW DELHI: Larger earners contribute extra to retirement merchandise, however the general contribution continues to be comparatively low for most people, suggesting that many individuals will not be saving sufficient for retirement, a survey confirmed on Wednesday.Almost 83% of members relied largely on three retirement merchandise: EPF, gratuity, and NPS. “This reliance on conventional schemes suggests restricted diversification in retirement portfolios,” stated the survey performed by consulting agency Grant Thornton Bharat.

The outcomes confirmed that greater than half (55%) of respondents count on a month-to-month pension exceeding Rs 1 lakh. Nonetheless, solely 11% consider their present investments are adequate to fulfill these expectations. “This stark disparity highlights a big preparedness hole that must be addressed by higher monetary planning and consciousness,” stated the report, the survey for which was performed by the consulting agency in Aug and Sept final yr.Govt-backed plans stay probably the most most popular possibility, with 39% of members favouring such schemes. About 27% of respondents confirmed a desire for personal plans supplied by respected monetary establishments. Excessive-risk, high-return plans have been significantly well-liked amongst youthful respondents, with 31% of members below 25 years curious about these choices. “This discovering suggests a rising urge for food for danger among the many youthful demographic,” stated the report.With regard to the age of retirement, about 56% of respondents stated they plan to retire between the age of 55 and 65. “This age vary aligns with customary retirement practices in India and displays the broader societal norms concerning work and retirement within the nation,” in accordance with the report. Youthful respondents, significantly those that have been 25 years or under, most popular early retirement. Amongst this group, 43% confirmed a desire to retire between 45-55 years. “Pattern signifies shift in attitudes amongst youthful staff, who might prioritise work-life steadiness & leisure over prolonged profession spans,” stated the report.The bulk, 74% of respondents, stated that they contribute between 1% and 15% of their wage towards retirement plans. “This contribution vary signifies a cautious strategy to financial savings, presumably influenced by monetary constraints or competing priorities,” stated the report. Requested to reply about their information of pension calculations, 52% of respondents stated they have been considerably conscious of how their pensions are decided, whereas 30% admitted to being utterly unaware.