Us fund jane st banned from d-st over ‘mkt manipulation’Mumbai: Markets Regulator Sebi Late on Cered Us-Based mostly Overseas Fund Jane Avenue from The Indian Marketplace for Manipulating Shares and Derivatives Segments Over A number of Years to Make HGE Positive factors. Jane st, know for his or her quant -based buying and selling methods, have additionally been requested to disgorge Practically Rs 4,850 RS 4,850 Crore – ILLEGAL GAINS ACCRUed to Them by Buying and selling on the NSE BETWEEN JAN 2023 and MARCH 2025 Sebi order stated. That is the highest-ever disgorgement Quantity Ordered by Sebi for Any Form of Unlawful Exercise within the Market.

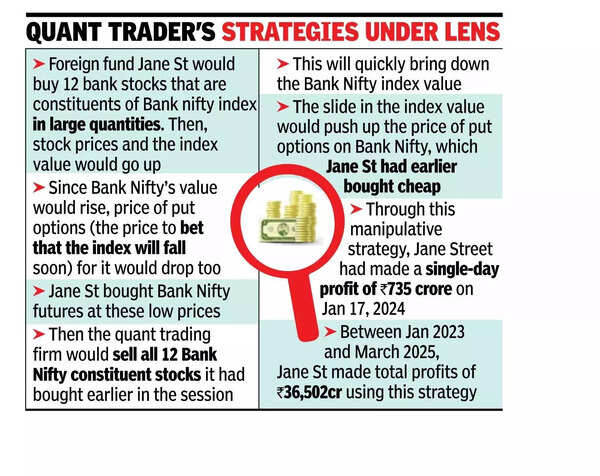

In an interim order, sebi banned jsi investments, JSI2 Investments, Jane Avenue Singapore and Jane Avenue Asia Buying and selling, From Buying and selling within the Indian Market Till Additional Discover. The Markets Regulator’s Investigation will proceed.A number of methods: Thus far, sebi has recognized two varieties of manipulative methods. One was to purchase closely in financial institution nifty’s 12 constituent shares and futures within the morning session, then boying put choices on the index, promoting the inventory within the inventory within the afternoon In flip pushed up index choices pructions to ultimately make enormous earnings. The opposite technique was to push for concentrated seling or shopping for within the final two hours of the expiry day to swing index ranges and makes rights.the funding. Some elements of the trades, earnings from the remainder greater than made up for the losses.Rs 36,502 Cr Earnings: Sebi’s Interim Investigation Confirmed That Between Jan 2023 and March 2025, Jane St Had Made a Complete Revenue of Rs 36,502 Crore. DURING That Interval, on Jan 17, 2024, The Buying and selling Agency Had Made A Revenue of Rs 735 Crore, The Highest Single-Day Acquire for the Now-Banned Overseas Fund.Nse warning letter: Whereas Sebi was Investigating Jane St’s Buying and selling Actions, on Feb 6, 2025, NSE Had Issued a Cauity Letter to Jane Avenue Singapore and its associated entity, its relationship, asking them to chorus from within the inguinals Market and to chorus from enterprise sure buying and selling patterns. Nonetheless, in disregard of nse’s warning letter, and the group’s commitments to the trade, “Jane st was noticed to proceed to proceed to run very giant Famous.Sources stated there’s a robust case that the interval of funding in addition to exchanges on which jane st had tradeed might be expanded to Unearth the total scale of manipulation within the Indian market by the use International Quant Buying and selling Big.“The Interim Order has solely checked out 18 Main Days of Prima Facie Financial institution Nifty Index Manipulation on Expiry Day Between jan 2023 and March 2025), and three days of nifty Index Manipulation on Expiration on Expiration 2025, “sources stated. “Investigations Into Different Expiry Days, different indices (Together with Throughout Exchanges), and different potential patterns in addition to the 2 highlighted within the Order might want to proceed.”“There shouldn’t be any Main market influence from this enforcement motion,” sources stated. “In the long term, the expansion in market confidence, and a free and truthful market, ought to help accountable funding and capital formation.”

(Tagstotranslate) India (T) India Information (T) India Information Right now (T) Right now Information (T) Google Information (T) Breaking Information (T) Jane Avenue Ban (T) Sebi Market Manipulation (T) Jane Avenue Disquitable (T) Jane Avenue Disquitable (T) India (T) Sebi Investigation Jane Avenue (T) Inventory Market Manipulation (T) NSE CATTER JANE STREET (T) Financial institution Nifty Manipulation