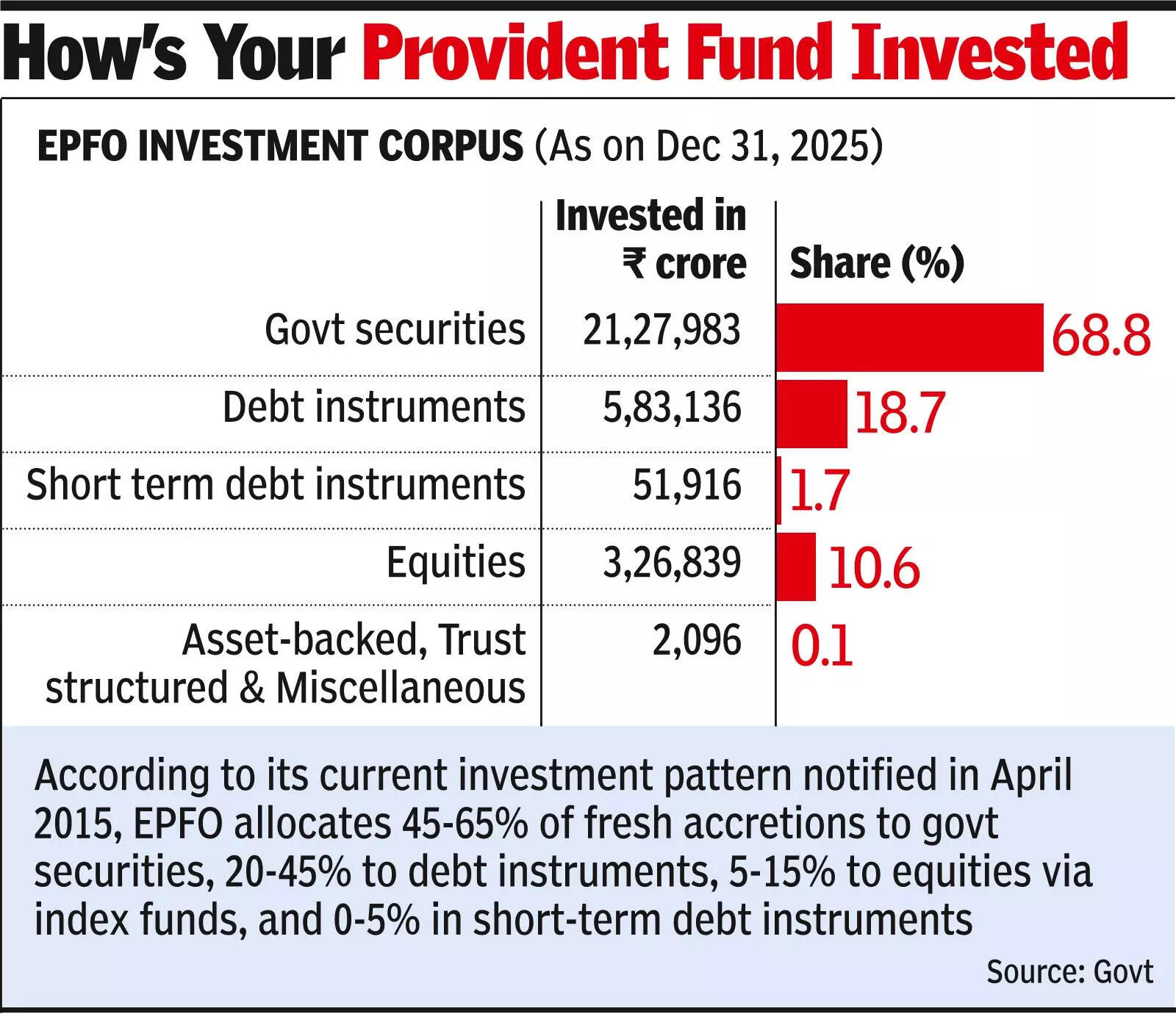

New Delhi: The Staff Provident Fund Organisation (EPFO) is prone to represent a high-powered committee to review its funding aims, coverage and pointers because it eyes greater returns on its practically Rs 31 lakh crore corpus primarily based on contribution from over 30 crore members. The problem was mentioned eventually week’s funding committee assembly, which was weighing the feasibility of investing within the fairness markets past change traded funds (ETFs), monitoring the benchmark NSE Nifty and BSE sensex indices. The panel, proposal for which got here from a govt consultant, will see consultants from a number of fields and govt departments, an individual who attended the assembly advised TOI. In accordance with its present funding sample notified in April 2015, EPFO allocates 45-65% of recent accretions to govt securities, whereas 20-45% goes in direction of investments in company debt papers, with as much as 5% permitted to be allotted in direction of short-term debt devices. That leaves round 5-15% of the move for equities, through index funds. As of Dec 31, it had invested practically 88% in govt bonds and 10.6% in equities, officers mentioned.

How’s your PF invested

Within the assembly, Crisil, which is the guide, offered the feasibility of investing in rising, dawn sectors akin to uncommon earths, railways and defence, together with analyzing yields of sectoral, issue and style-based indices. Among the doable sectoral indices included these monitoring banking and monetary companies, info know-how, world indices, and FMCG. It additionally assessed indices that observe momentum shares, worth shares, and low volatility shares. The retirement fund physique is at work to extend its earnings as it’s saying considerably greater annual returns for its members than prevailing yields on govt bonds in recent times, the place most of its funds are parked. It’s set to announce the rate of interest for the present monetary yr subsequent month. Final yr, the RBI had recommended a collection of measures to “enhance” its funding administration and accounting practices. It has appointed the IIM Kozhikode to look at its fairness exit coverage and the curiosity stabilisation reserve. In addition to, the funding panel additionally authorised the proposal to introduce performance-linked incentives for its fund managers, whereby it should allocate larger funds to those that give higher returns, as a part of the brand new benchmark methodology for its debt investments. “The brand new benchmark methodology consists of an accelerated detrimental marking provision for any fund supervisor who fails to fulfill it, which can adversely have an effect on its portfolio allocation. The brand new methodology additionally discourages the fund managers from parking funds in low-yielding TREPS that are principally short-term, low-risk cash market devices,” the supply added.