Mexico’s Senate Wednesday voted in favour of a invoice that imposes tariffs of 5% to 50% on over 1,400 merchandise from Asian nations, together with India. The levies will take impact from subsequent 12 months and hit merchandise starting from clothes to auto components, with the large output of Chinese language factories rising because the laws’s focus.

Exports Of Auto, Parts, Amongst Others Will Be Hit

For India, which has a commerce surplus with Mexico, this could possibly be unhealthy information for cars and auto components. Annual exports of corporations akin to Volkswagen, Hyundai and Maruti Suzuki added as much as round $1.1bn with 90,000 items being shipped. Two-wheeler manufacturers like Royal Enfield, TVS, Bajaj and Honda may additionally be hit.

Mexico’s resolution to impose 5-50% tariffs to have an effect on India

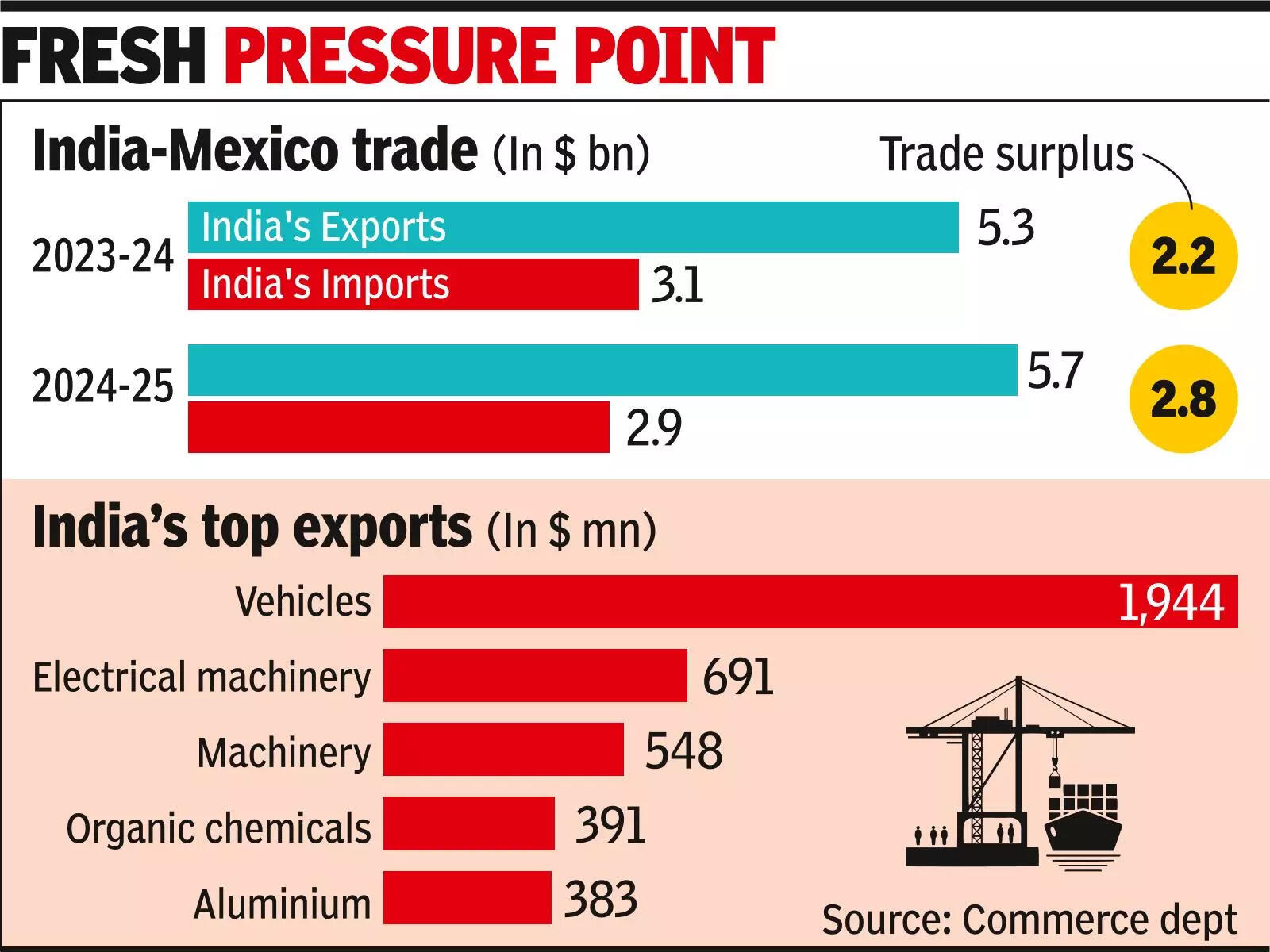

After the US, now Mexico is erecting tariff limitations for international locations with which it doesn’t have a commerce settlement, together with India.Mexico’s Senate on Wednesday voted in favour of a invoice that imposes tariffs between 5% and 50% on greater than 1,400 merchandise from Asian nations, Bloomberg reported. The brand new levies will take impact beginning subsequent 12 months and hit a variety of merchandise from clothes to metals and auto components, with the large output of Chinese language factories rising because the laws’s focus.For India, which has a commerce surplus with Mexico, the transfer could possibly be unhealthy information for cars and auto components. Corporations akin to Volkswagen, Hyundai and Maruti Suzuki, whose exports added as much as round $1.1 billion in 2024-25, shipments of round 90,000 items could also be hit.“India has been a powerful export base for Skoda Auto Volkswagen for a few years and that continues to information how we construct and engineer vehicles for world markets… Mexico has constantly been one in every of our necessary export markets, given rising demand there and traction of India-made fashions. We’re monitoring the scenario. For the second, now we have come to the conclusion that our enterprise actions are usually not affected,” Skoda Auto Volkswagen mentioned.Two-wheeler manufacturers akin to Royal Enfield, TVS, Bajaj and Honda are additionally understood to be exporting to the Latin American nation. In addition to, part exports to Mexico had been estimated at round $850 million in 2024-25 and a few of these had been utilized by corporations to fabricate automobiles headed to the US.“India’s auto part exports to Mexico largely comprise powertrain and driveline components, precision forgings, chassis and brake programs, and key electrical and after-market merchandise. There’s a sturdy demand, particularly for forgings and precision machined elements,” Auto Element Producers Affiliation director normal Vinnie Mehta informed TOI.Whereas larger taxes will yield round $2.8 billion income for the Mexican govt, it’s seen to have dealing with US President Donald Trump’s strain on Mexican President Claudia Sheinbaum to cut back imports from China.“…(It) is a sign of deepening world commerce tensions, carefully linked to future bilateral agreements. That is prone to disrupt established provide chains that used Mexico as a base to push exports into US … sectors akin to auto elements, textile, and engineering items are prone to be impacted by these tariffs. The brand new Mexico tariffs starting from 35% to 50% on these merchandise will make Indian exports by way of the international locations with US FTA extra cost-competitive if Indian is ready to conclude long-term bilateral agreements with these nations,” mentioned Saurabh Agarwal, tax companion at EY India.