India’s IPO (Preliminary Public Choices) market is booming, although the secondary market has seen timid returns this 12 months. Pattern this: In a time span of simply 6.5 hours, the LG Electronics India IPO of $1.3 billion was oversubscribed! LG Electronics India IPO noticed the quickest oversubscription in over 17 years amongst main IPOs within the Indian market.In the present day, Lenskart Options Ltd IPO garnered robust response throughout its first day of subscription, primarily supported by institutional and particular person traders. In response to NSE figures, the IPO, valued at Rs 7,278-crore, attracted bids for 11,22,94,482 shares in comparison with the obtainable 9,97,61,257 shares, reaching a subscription fee of 1.13 instances.LG, the house home equipment producer, noticed exceptional IPO success with subscriptions reaching $200 million per hour! The three-day subscription interval noticed home individuals, together with establishments and particular person traders, accounting for 60% of whole bids, other than the anchor guide allocation. The corporate’s shares rose by 48% upon market debut.

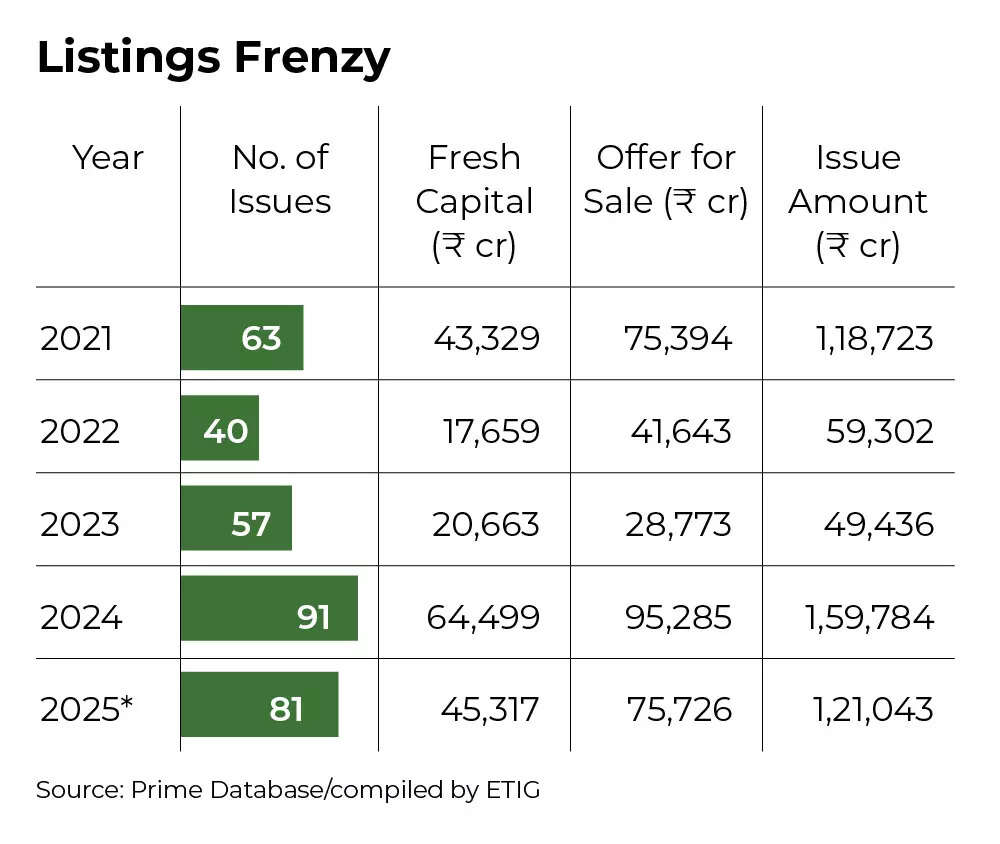

IPO Itemizing Frenzy

Within the context of Indian IPOs with minimal fundraising of Rs 100 billion, LG’s subscription fee was unmatched since January 2008, when Reliance Energy Ltd. accomplished its record-breaking providing in underneath a minute.So, what’s driving the frenzy? The attention-grabbing truth is that home traders are betting large on the brand new affords.

India’s IPO frenzy: The basic shift

IPOs resembling LG’s, which is the third-largest this 12 months within the Indian markets, have positioned India as one of many world’s most lively IPO locations, with whole proceeds advancing in the direction of final 12 months’s unprecedented $21 billion mark, in line with a Bloomberg report.A swiftly rising pool of capital from home mutual funds, insurance coverage firms and numerous retail traders now instructions the IPO panorama – a indisputable fact that demonstrates past doubt the improved functionality to accommodate big share choices. Importantly, this pattern highlights the lowering dependence of India’s fairness capital markets on overseas inflows, indicating a elementary transformation that specialists consider will foster a self-sufficient IPO ecosystem.

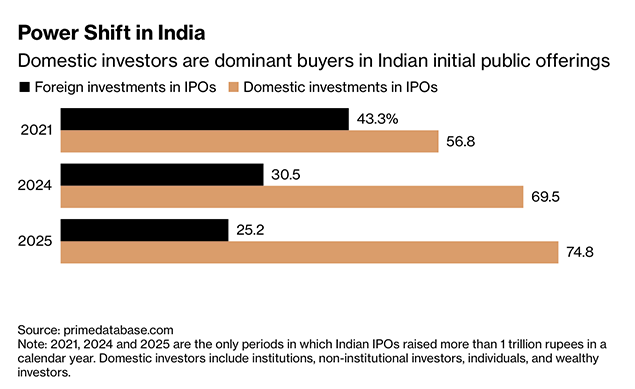

Energy shift in India

Whereas the market enthusiasm brings potential dangers, notably with some firms exhibiting inflated valuations and small IPOs seeing subscription charges of over 100 instances, there are issues about attainable market changes that would negatively affect retail traders, the Bloomberg report mentioned.Knowledge from Prime Database reveals that home traders have invested Rs 979 billion rupees in IPOs since 2024 starting, in comparison with overseas funds’ contribution of Rs 790 billion. Home funding participation in IPOs has grown persistently, reaching roughly 75% for 2025, marking the best proportion for any 12 months the place proceeds surpassed 1 trillion rupees ($11.3 billion).“The market goes by a sea change,” Abhinav Bharti, head of India fairness capital markets at JPMorgan Chase & Co informed Bloomberg. “Households are deploying an increasing number of of their financial savings into equities by mutual funds and that capital is getting channeled into capital markets.”

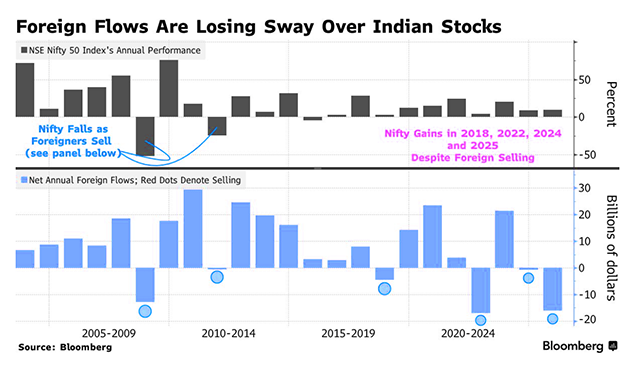

International flows are dropping sway over Indian shares

Assuming no important disruptions happen, this substantial pool of funding capital may present sustained market help within the forthcoming years, he famous.India’s IPO panorama is present process transformation, mirroring modifications in its $5.3 trillion fairness market throughout latest years, pushed by substantial retail funding development following the pandemic.Divya Agrawal, Analysis Analyst & Advisory (Elementary), Wealth Administration at Motilal Oswal Monetary Providers Ltd is of the view that this surge displays deep native liquidity, with each retail and institutional traders anchoring demand. “Retail enthusiasm continues to drive oversubscriptions throughout latest choices, supported by increasing demat penetration and seamless digital entry. On the institutional aspect, home mutual funds and insurers have develop into dominant anchors, typically main QIB books at the same time as overseas flows stay selective,” she informed TOI.The accessibility of buying and selling purposes, simplified account creation processes, and widespread funding training content material on social platforms have attracted many first-time market individuals.Conservative traders are contributing billions by month-to-month systematic funding plans into home mutual funds, taking part in a market the place the benchmark index is heading in the direction of its tenth consecutive yearly achieve.Home institutional traders have elevated their possession in over 2,000 NSE-listed firms to 19.2% as of June, reaching a 25-year peak, in line with change information. In the meantime, overseas portfolio traders’ holdings have declined to 17.3%, marking their lowest degree in over ten years.Indian IPOs have confirmed notably worthwhile for traders, delivering a weighted common return of 18% this 12 months, surpassing the NSE Nifty 50 Index’s 9.7% enhance. The benchmark’s development is especially important given the overseas outflows of roughly $16 billion from the market, approaching the second-largest withdrawal on file. Home traders, primarily mutual funds and insurance coverage firms, have compensated by investing greater than $70 billion, in line with the Bloomberg report.The robust participation from home traders has made the fairness market a horny platform for firms looking for to lift capital, notably as they intention to use alternatives in India’s quickly increasing financial system.“On a regular basis there’s a roadshow,” mentioned Vivek Toshniwal, chief govt officer of Mumbai-based household workplace Plutus Wealth Administration LLP, which invests in IPOs. “A euphoria like that is unprecedented.”Narendra Solanki, Head Elementary Analysis – Funding Providers, Anand Rathi Share and Inventory Brokers Restricted says that with two months nonetheless left for the 12 months and looking out on the pending lineup, 2025 might surpass the earlier 12 months in each quantity and quantity raised in main markets.“Enthusiasm in traders is presently very excessive as they stay up for investing in new firms and companies for long run wealth technology,” he informed TOI.Amongst the anticipated important choices anticipated inside the subsequent 24 months are Reliance Jio Infocomm Ltd., Nationwide Inventory Alternate of India Ltd., and Flipkart India Pvt., backed by Walmart. Extra listings embrace PhonePe Ltd. (Walmart-supported), Hindustan Coca-Cola Drinks Pvt., SBI Funds Administration Ltd., Manipal Hospitals Pvt. and Avaada Electro Pvt., supported by Brookfield.

India’s IPO market increase: The issues

Pratik Loonker, who leads fairness capital markets at Axis Capital Ltd., signifies that latest years have proven unprecedented exercise all through his skilled expertise of greater than twenty years.“It is a virtuous cycle” with mutual funds’ participation, mentioned Loonker. “They make alpha, which suggests they make affordable returns for particular person shareholders who’re contributors to those mutual funds. And if that occurs, an increasing number of people come to the market to present cash to those asset managers to handle, which suggests they’ve extra capital to deploy once more.” Alpha signifies returns that exceed market benchmarks.The present IPO panorama reveals larger selection in comparison with the 2021 surge, which was primarily concentrated in technology-based startups. Earlier choices included firms like Everlasting Ltd. (previously Zomato), One 97 Communications Ltd. (Paytm’s guardian firm), and FSN E-Commerce Ventures Pvt, the organisation behind Nykaa.Though these earlier choices initially obtained enthusiastic responses, their share costs subsequently declined because of valuation issues and worldwide rate of interest will increase. Amongst these, solely Everlasting’s shares have recovered to surpass their preliminary providing value.In response to Loonker of Axis Capital, this case presents an ongoing concern. He signifies that inappropriate valuation of IPOs may probably have an effect on the presently steady market situations.“If 5 – 6 giant IPOs have poor listings, that may rapidly spoil the get together,” he mentioned.Vinod Nair, Head of Analysis at Geojit Investments Restricted informed TOI, “Home traders are actively investing in IPOs with the identical enthusiasm witnessed in CY24, which recorded the best variety of public placements traditionally. This pattern persists regardless of the underperformance of the secondary market over the previous 12-13 months. Moreover, the itemizing good points from CY25 IPOs have been considerably decrease than these seen in CY24 and CY23, which averaged good points of 25-30%. We attribute this poor efficiency to the dearth of high quality firms being provided and excessive valuation necessities. Nonetheless, these elements haven’t dampened the spirits of home traders, who stay buoyant, bolstered by excessive liquidity and the historic good points made up to now 2-3 years.”Regardless of the general constructive efficiency of Indian IPOs this 12 months, Bloomberg information reveals that roughly half of the listings throughout main and secondary boards have fallen beneath their difficulty value. The underperformers primarily encompass firms with fundraising beneath $100 million, though important choices like HDB Monetary Providers Ltd.’s $1.5 billion IPO have additionally declined.Latest information signifies diminishing fast returns from most important board IPOs. A Bloomberg evaluation reveals the median one-month post-listing return has decreased to 2.9% within the present 12 months, in comparison with 22% within the earlier 12 months.

India’s IPO market sees ‘China-like’ increase

Following over 300 listings which have generated practically $16 billion in 2025, India ranks because the fourth most lively IPO vacation spot globally, as Bloomberg information signifies. Inside Asia, solely Hong Kong and mainland China have surpassed India’s proceeds.Saurabh Dinakar, who heads Morgan Stanley’s Asia-Pacific world capital markets, anticipates 2026 will see record-breaking IPO proceeds.He compares India’s present IPO surge to China’s scenario from 10-15 years in the past, noting that India’s current financial situations, together with an increasing center class and elevated web accessibility, mirror the elements that facilitated the expansion of Chinese language tech firms into outstanding public entities.Latest regulatory modifications have created a supportive setting. The securities market regulator applied modifications in September to streamline giant non-public firms’ public itemizing course of, while the central financial institution just lately eased restrictions on IPO-related lending.Rita Tahilramani, funding director at Aberdeen Investments in Singapore, notes that IPOs are introducing novel sectors resembling fintech and renewables, alongside rising industries presently unavailable in secondary markets.She observes that market growth is happening by these new firm listings, supported by substantial obtainable liquidity.In response to Tracxn Applied sciences Ltd., India ranks third globally in unicorn firms, internet hosting over 90 non-public organisations valued above $1 billion, following the US and China.