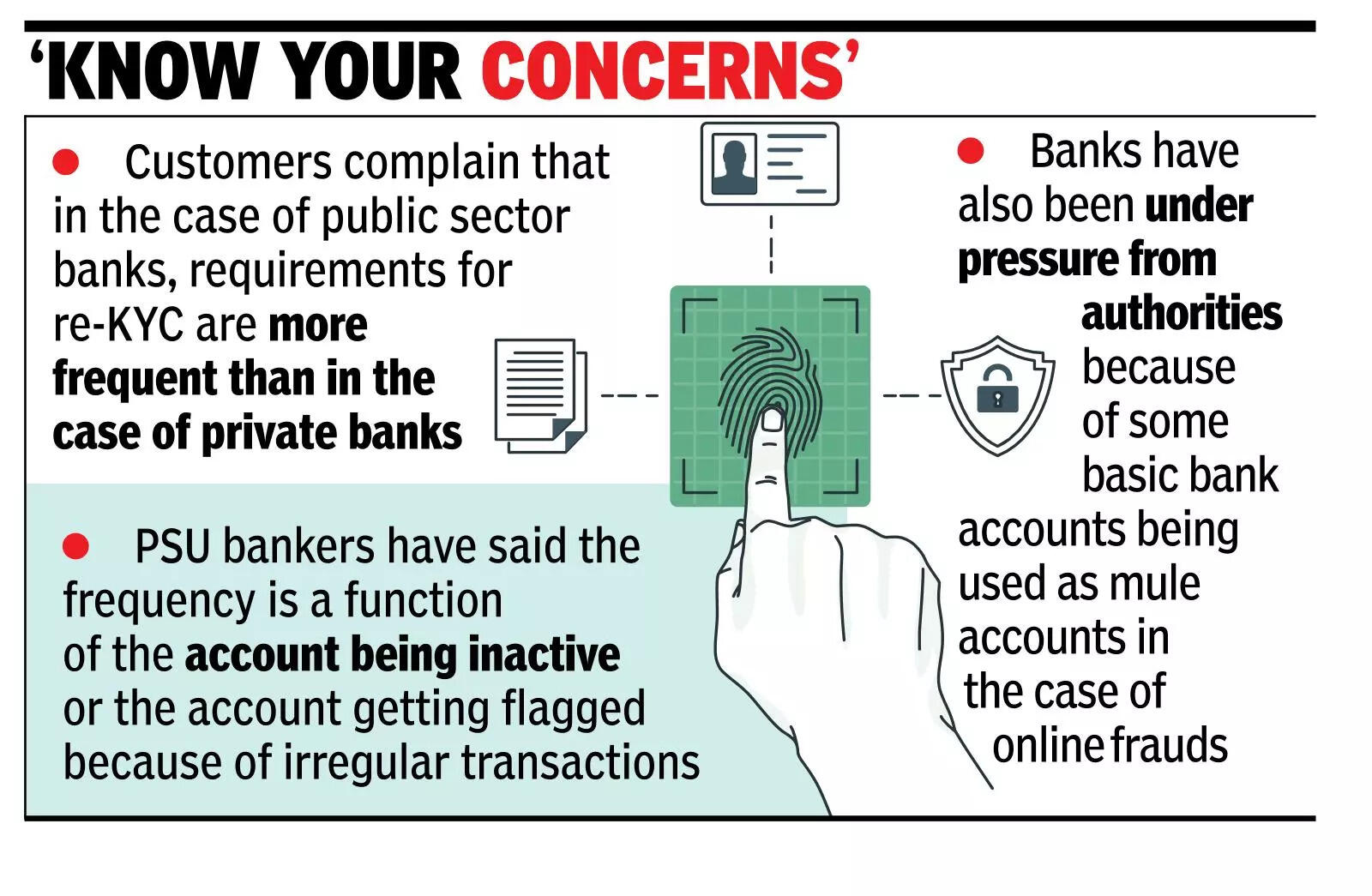

MUMBAI: The nation’s largest lender SBI is participating with regulators to simplify its ‘know your buyer’ (KYC) course of, chairman C S Setty stated, underlining the financial institution’s efforts to enhance entry and high quality of economic companies. “Simplifying KYC and re-KYC processes is essential for each prospects and banks. We’re taking initiatives from SBI’s aspect to interact with regulators and simplify the method,” he stated.Regardless of its intent to replace buyer information and curb fraud, various practices have made re-KYC a compliance problem for a lot of Indians. Some prospects have complained that they’re referred to as for re-KYC as soon as in two years and confronted the chance of being barred from transacting on their financial institution accounts if they didn’t comply.Prospects have complained that within the case of public sector banks the necessities for re-KYC are extra frequent than within the case of personal banks. PSU bankers stated that the frequency can be a perform of the account being inactive or the account getting flagged due to irregular transactions. Banks have additionally been below strain from authorities due to some fundamental financial institution accounts getting used as mule accounts within the case of on-line frauds.

Earlier, in an interview to TOI, RBI governor Sanjay Malhotra had stated that buyer comfort stays a key precedence and simplifying KYC is central to that effort. He stated that the hassle was to make sure that as soon as KYC is accomplished with one regulated entity, it ought to apply throughout all others, and handle updates ought to robotically mirror however no particular timeline has been set for full implementation.Talking on the International Fintech Fest right here on Wednesday, Setty famous SBI’s mixture of digital and bodily presence. “Now we have about 1.6 lakh contact factors at this time. It isn’t solely digital channels; we’re additionally reimagining bodily shops to make sure companies are accessible throughout the nation,” he stated. SBI’s contact centres deal with over 60% of visitors from rural and semi-urban areas, offering companies in 15 languages, reflecting the financial institution’s give attention to inclusive banking.Setty harassed serving India’s numerous buyer base, from first-time account holders to high-net-worth people. “Offering scale and entry is a problem given India’s demographic and geographic variety. In the present day, our 520 million prospects are by no means denied service, whether or not it’s fundamental banking or wealth administration,” he stated.Expertise has accelerated buyer onboarding. “Earlier, onboarding at a department may take an hour. In the present day, utilizing e-Aadhaar and the reimagined Yono portal, we full it in 10-Quarter-hour,” Setty stated. SBI’s Yono 2.0 app will develop to fifteen languages and give attention to merchandise for farmers, MSMEs, and monetary prospects.On monetary inclusion, Setty famous SBI’s 2.5 million enterprise correspondents present 33 banking companies throughout rural, semi-urban, and concrete areas. He pointed to PMJDY (PM Jan Dhan Yojana) accounts: 150 million gender accounts opened, 99.5% funded, with 56% operated by girls.Setty additionally famous that one-third of SBI’s buyer base is below 35 and harassed life-cycle monetary administration, together with training loans.