US President Donald Trump is disrupting the world financial system along with his reciprocal tariffs – however India is nicely positioned not solely towards the hostile affect of those strikes, however may very well be capable of take long-term benefit from America’s excessive duties, says Moody’s in its newest report.Moody’s has mentioned that India’s sturdy home market and minimal export dependency place it favourably to face up to hostile impacts from Trump’s tariffs and international commerce disruptions.“India is best positioned than many different rising markets to take care of US tariffs and international commerce disruptions, helped by sturdy inside development drivers, a large home financial system and a low dependence on items commerce,” it says.The in depth tariff revisions introduced by Trump on April 2 mark probably the most substantial tariff improve for the reason that Thirties. The reciprocal tariff scheme initially imposed an extra 26% obligation on Indian exports to America.Additionally Learn | First section of India-US commerce deal seemingly earlier than July; India desires full exemption from Donald Trump’s 26% tariffs on sure items: ReportSubsequently, on April 9, the Trump administration instituted a 90-day pause on implementing most tariffs, establishing a uniform 10% fee for practically all focused nations.The implementation of 10% common tariffs, coupled with 30% duties on Chinese language exports to America, is anticipated to limit international financial development. This might cut back India’s GDP development to six.3% from 6.7% in calendar 12 months 2025. However, India would nonetheless stay the nation with highest amongst G-20 nations, notes Moody’s.What works in India’s favour? Moody’s explains1. India’s financial development stays anchored by home consumption, whilst US coverage modifications pose dangers. Authorities expenditure on infrastructure contributes to GDP development, complemented by decreased private taxation that encourages spending, notes Moody’s. 2. India’s modest dependence on items commerce and powerful providers business present safety towards US tariff impacts. India faces minimal direct affect from commerce tensions. Though the US stays India’s main export market, the affect on India’s financial development stays restricted, says Moody’s. This is because of momentary reduction measures and India’s comparatively decrease dependence on items exports relative to different Asia-Pacific rising economies.

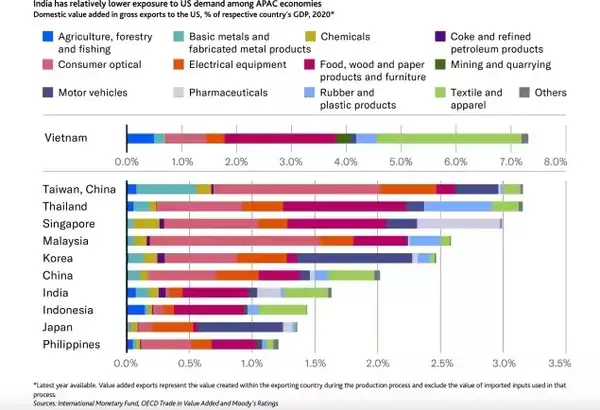

India has comparatively decrease publicity to US demand amongst APAC international locations (Moody’s)

3. Indian merchandise may doubtlessly achieve from elevated US purchases if negotiations end in preferential tariff remedy in comparison with different creating nations.4. Infrastructure sector development is accelerating via sustained funding. Constant necessities throughout energy technology, transport networks and digital techniques proceed to attract substantial capital commitments over the upcoming 5-7 years. US commerce measures are anticipated to have restricted affect on most infrastructure segments resulting from their main concentrate on home market necessities.5. Native market focus offers insulation to non-financial enterprises from tariff results. The growth of infrastructure alongside constructive inhabitants dynamics helps Indian non-financial firms’ operations. Notable authorities capital allocation strengthens numerous sectors together with building, useful resource extraction and industrial manufacturing.6. India’s banking business demonstrates resilience towards potential market volatility. Indian banks exhibit sturdy monetary well being via robust income and capital reserves.Additionally Learn | Profit for India: How Indian ports will achieve from China+1 technique – Moody’s explains7. In Could 2025, India and the UK finalised a complete free-trade settlement after in depth negotiations. This settlement signifies a shift in the direction of commerce openness as a strategic response to US tariff measures, contrasting with India’s conventional protecting commerce stance. Concurrent negotiations proceed with the European Union for the same FTA, while discussions with the US concentrate on decreasing the punitive tariffs applied in April.8. India’s demographic benefit considerably contributes to its financial development. The nation’s substantial youthful inhabitants reveals elevated spending tendencies, each for private wants and their offspring, not like earlier generations. The increasing client credit score business additional strengthens this consumption sample.The negatives* Some industries face present or forthcoming sector-specific tariffs. The US has imposed 25% tax on imported autos, car elements, metal and aluminium, negatively affecting firms in these industries.* The vast majority of Indian companies rated by Moody’s in these sectors have minimal direct US market publicity or possess enough safeguards, together with sturdy home operations, diversified provide networks and US-based amenities, to handle the affect. However, they continue to be inclined to commerce movement disruptions and attainable regional provide will increase, notably from China.

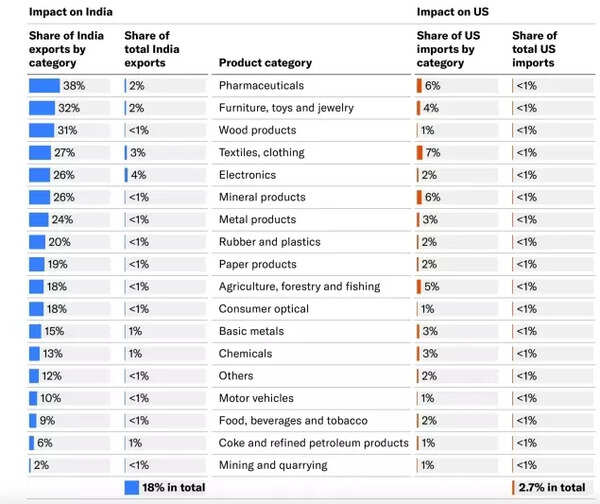

Indian items most uncovered to US tariffs based mostly on 2024 commerce information (Moody’s)

* Moreover, the Trump administration is contemplating tariffs on extra sectors, together with prescription drugs, which represents one in every of India’s largest export classes to the US, except ongoing commerce negotiations between each nations produce substantial outcomes.* Though in a roundabout way affected by tariffs, enterprise service organisations face dangers from US immigration coverage modifications. Extra stringent US immigration laws will cut back the workforce availability and prohibit operations of Indian service suppliers who deploy their employees to the US. Regardless of service companies step by step growing native US recruitment, many nonetheless depend upon expert H1B visa employees for prolonged US assignments, making them susceptible to immigration coverage modifications and elevated operational prices.Additionally Learn | Why Apple received’t discover it simple to maneuver iPhone manufacturing from India to USLengthy-Time period Benefit IndiaMoody’s is of the view that prime tariffs will drive provide chain relocations nearer to end-consumer markets. India stands to achieve from potential funding flows concentrating on its substantial and increasing market, which may reverse the present downward development in overseas direct investments.In the long term, elevated US tariffs on different APAC rising economies like China, Vietnam, Thailand and Cambodia current alternatives for India to extend its US market share in textiles, attire, footwear and electronics exports.The expansion of labour-intensive manufacturing sectors will contribute to job creation.The electronics business’s potential to capitalise on ongoing provide chain alterations will depend on commerce and funding coverage changes that allow smoother cross-border motion of intermediate merchandise, fostering regional connectivity. To place it merely…How a India-US commerce deal will work out is anyone’s guess – discussions are ongoing and analysts hope {that a} mutually useful deal will come via shortly. Stories recommend {that a} three-phase deal is in works, with the primary section prone to be finalised earlier than July, which is across the time that the 90 day tariff pause deadline ends.In the meantime, India is about to overhaul Japan to grow to be the world’s fourth largest financial system this 12 months. Within the coming years, it’ll grow to be the third largest after United States and China. As specialists acknowledge globally, the Indian financial system’s largest energy lies in its essentially sound home development story. Because it appears to be like to extend the share of exports in its GDP, commerce offers with international locations aside from the US may even play a vital function.Moreover, a relative tariff benefit over main economies like China, might finally work in India’s favour with the China+1 technique bearing fruit because the world expands provide chains in India.Additionally Learn | Benefit or drawback? How the US-China commerce deal will seemingly affect India – defined